FHA Loans With Tax Lien

This comprehensive guide will explore FHA loans with Tax Lien. How they work, and the steps you can take to navigate this situation. What happens when you have a tax lien? Can you still qualify for an FHA loan?

FHA loans, or Federal Housing Administration loans, have been a popular choice for homebuyers for decades. These loans are crafted to enhance the accessibility of homeownership by providing reduced down payment prerequisites and increased flexibility in qualifying criteria than conventional mortgages.

FHA loans are government-backed mortgages insured by the Federal Housing Administration, a segment within the United States HUD (Department of Housing and Urban Development). These loans were created to help people with diminished credit scores and constrained financial means to become homeowners.

Learn more about FHA Loans with Tax Lien with us. Click here.

Key features of FHA loans include:

- Lower down payment requirements (typically as low as 3.5% of the purchase price).

- More flexible credit score requirements.

- Competitive interest rates.

- Fixed-rate and adjustable-rate options.

- Lenient debt-to-income ratio guidelines.

- Accessibility for first-time homebuyers.

FHA loans are popular among borrowers who may need to meet the stringent requirements of conventional mortgages.

What is a Tax Lien?

Before we delve into FHA loans with tax lien, let’s clarify what a tax lien is. A tax lien represents a lawful assertion initiated by a governmental organization, like the Internal Revenue Service (IRS) or state tax authorities, against a person’s property or assets when they fail to pay taxes. This lien serves as collateral, ensuring the tax debt will be repaid when the property is sold.

Tax liens can affect various assets, including real estate, vehicles, bank accounts, and personal property. They can severely impact your financial standing, making it challenging to obtain credit or financing.

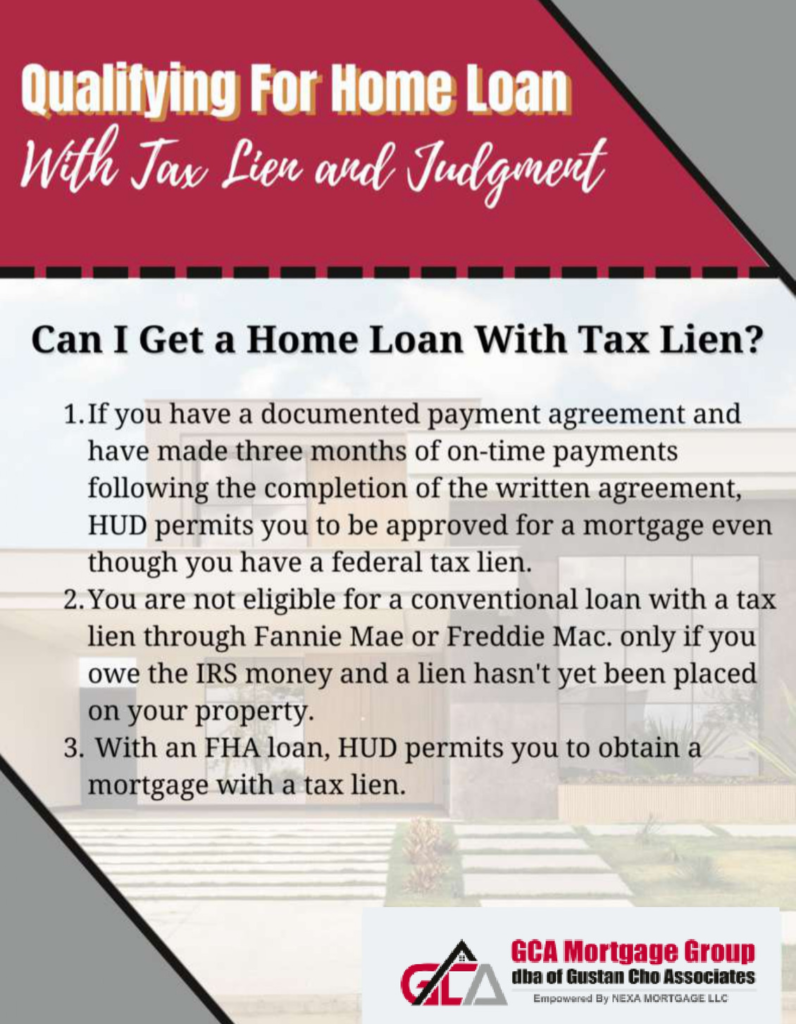

Can You Get FHA Loans with Tax Lien?

The short answer is yes, it is possible to get FHA loans with tax lien. However, it’s essential to understand that tax liens can complicate the loan application process and impact your eligibility. FHA loans are structured to enhance accessibility but still have requirements that borrowers must meet.

FHA Loans with Tax Lien: What are the impacts in application?

Having a tax lien on your record can affect your FHA loan application in several ways:

Credit Score and History:

FHA loans are known for being more forgiving regarding credit scores. However, a tax lien can still hurt your credit score. The amount of the lien, when it was filed, and your overall credit history will all play a role in how significantly it affects your creditworthiness.

Eligibility:

FHA loans have specific eligibility requirements, including income and employment stability. A tax lien may raise concerns for lenders about your ability to meet these requirements.

Loan Amount:

The amount of the tax lien can also affect your loan amount. If the lien is substantial, it may reduce the amount you qualify for under an FHA loan.

Interest Rate:

Although FHA loans typically provide attractive interest rates, having a tax lien may result in a slightly higher interest rate due to the perceived increased risk for lenders.

Get pre-approved in just 5 minutes!

Steps to Qualify for FHA Loans with Tax Lien

If you have a tax lien and want to pursue an FHA loan, there are specific actions you can pursue to enhance your likelihood of approval:

Review Your Credit Report: Commence by securing a copy of your credit report from the 3 major credit bureaus which are Equifax, Experian, and TransUnion. Carefully review the report for accuracy, and if there are any errors related to the tax lien, dispute them.

Pay Off or Settle the Tax Lien: Paying off or settling the tax lien is one of the most effective ways to improve your eligibility for an FHA loan. Lenders prefer borrowers with resolved tax issues. Contact the taxing authority to discuss payment options and negotiate a settlement if possible.

Build a Positive Payment History: After resolving the tax lien, focus on building a positive payment history. Ensure that you make punctual payments for all your debts and obligations to demonstrate your financial responsibility.

Save for a Larger Down Payment: If the tax lien continues to be present on your credit report, contemplate setting aside funds for a more substantial down payment. A larger down payment can offset some of the perceived risk of the lien.

Work with an Experienced FHA Lender: Not all lenders are experienced in handling FHA loans with tax liens. Choose a lender with expertise in this area who can guide you through the process and help you navigate any challenges that may arise.

Paying Off Tax Liens

Paying off a tax lien is a significant step towards improving your financial health and FHA loan eligibility. Here are some options for dealing with tax liens:

Pay in Full: Paying the tax lien in full is the most straightforward option. Once paid, the lien will be released, and it should reflect positively on your credit report.

Negotiate a Settlement: On occasion, you have the opportunity to engage in negotiations for a settlement with the taxing authority. They may accept a partial payment to release the lien. Be sure to get any settlement agreement in writing.

Enter into a Payment Plan: If paying the full amount immediately is not feasible, you might have the option to establish a payment arrangement with the taxing authority. It’s crucial to ensure strict adherence to the stipulations of the arrangement.

Dispute the Lien: In case you suspect inaccuracies or incorrect filing, you have the option to contest the tax lien. This process involves providing evidence to support your claim and working with the taxing authority to resolve the issue.

Do you have questions about paying off tax liens? Talk to a loan officer.

Approval of FHA Loans with Tax Lien

Once you have addressed your tax lien and improved your creditworthiness, you can proceed with your FHA loan application. Keep in mind that every lender might have slightly varying prerequisites, so working closely with your chosen lender throughout the process is essential.

Documentation: Gather all essential documentation, which encompasses evidence of income, employment records, and any paperwork linked to the resolution of your tax lien.

Down Payment: Ensure you have the required down payment amount available. Generally, FHA loans necessitate a minimum down payment equivalent to 3.5% of the purchase price.

Credit History: Lenders will closely examine your credit history, including the tax lien status and recent credit activity.

Work with an FHA-Approved Lender: Select an FHA-approved lender experienced in handling loan applications with tax liens. They can guide you through the process and provide valuable insights.

Be Prepared for Additional Documentation: Lenders may request additional documentation or explanations regarding your financial history, tax lien resolution, or other aspects of your application.

In conclusion, while having a tax lien can present challenges when applying for an FHA loan, it is a manageable obstacle. Taking proactive steps to address the lien, improve your creditworthiness, and work with an experienced FHA lender can increase your chances of obtaining the loan you need to achieve homeownership.

Frequently Asked Questions (FAQs)

- 1. Can I get an FHA loan if I have a tax lien on my credit report?

Yes, qualifying for an FHA loan with a tax lien on your credit report may be possible, but you will need to meet specific requirements.

2. What is a tax lien, and how does it affect my ability to get an FHA loan?

A tax lien is a legal claim by a government authority against your property or assets due to unpaid taxes. Tax liens can negatively impact your credit and make qualifying for an FHA loan more challenging.

3. Are there specific requirements for approval of FHA loans with tax lien?

You may need to satisfy specific requirements, such as setting up a repayment plan, making satisfactory payment arrangements with the taxing authority, and demonstrating a history of on-time payments.

4. Can I apply for an FHA loan if I have a federal tax lien?

Qualifying for an FHA loan with a federal tax lien may be possible. Still, you must meet specific guidelines and have a repayment plan.

5. What can I do to enhance my prospects of getting approved for FHA loans with tax lien on my credit?

To enhance your approval chances, you should work on resolving the tax lien, establishing a repayment plan, and making consistent payments as required.

6. Can I use an FHA 203(k) loan with a tax lien to finance a home purchase or renovation?

Using an FHA 203(k) loan for a home purchase or renovation may be possible if you have a tax lien, but you must address the tax lien as part of the process.

7. How long do I need to wait after resolving a tax lien before applying for an FHA loan?

The waiting period after resolving a tax lien can vary. Still, you may need to demonstrate a history of responsible financial behavior before applying for an FHA loan.

8. Are there additional documentation and requirements for FHA loans with tax lien?

You may be required to provide documentation related to the tax lien, such as proof of payment or a repayment plan agreement.

9. Should I work with an experienced FHA lender or mortgage professional if I have a tax lien?

When dealing with tax liens, seeking guidance from an experienced FHA lender or mortgage professional is advisable. They can help you navigate the process and ensure you meet all requirements.

Bear in mind that each circumstance is distinct, and it’s advisable to seek expert guidance and guidance is essential when dealing with tax liens and FHA loans. With determination and the right support, you can overcome these challenges and move closer to your goal of becoming a homeowner with an FHA loan.

Gustan Cho Associates has expert loan officers that can help you with FHA Loans with Tax Lien. Contact us now by calling 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays!