No-Doc Home Loans on Primary Residential Homes

This blog will cover and discuss non-doc home loans on primary residential homes. No-Doc Home Loans was the most popular loan program before the 2008 financial crisis. Self-employed borrowers who do not meet the qualified income guidelines on traditional mortgage loan programs can now qualify for non-doc home loans at Gustan Cho Associates.

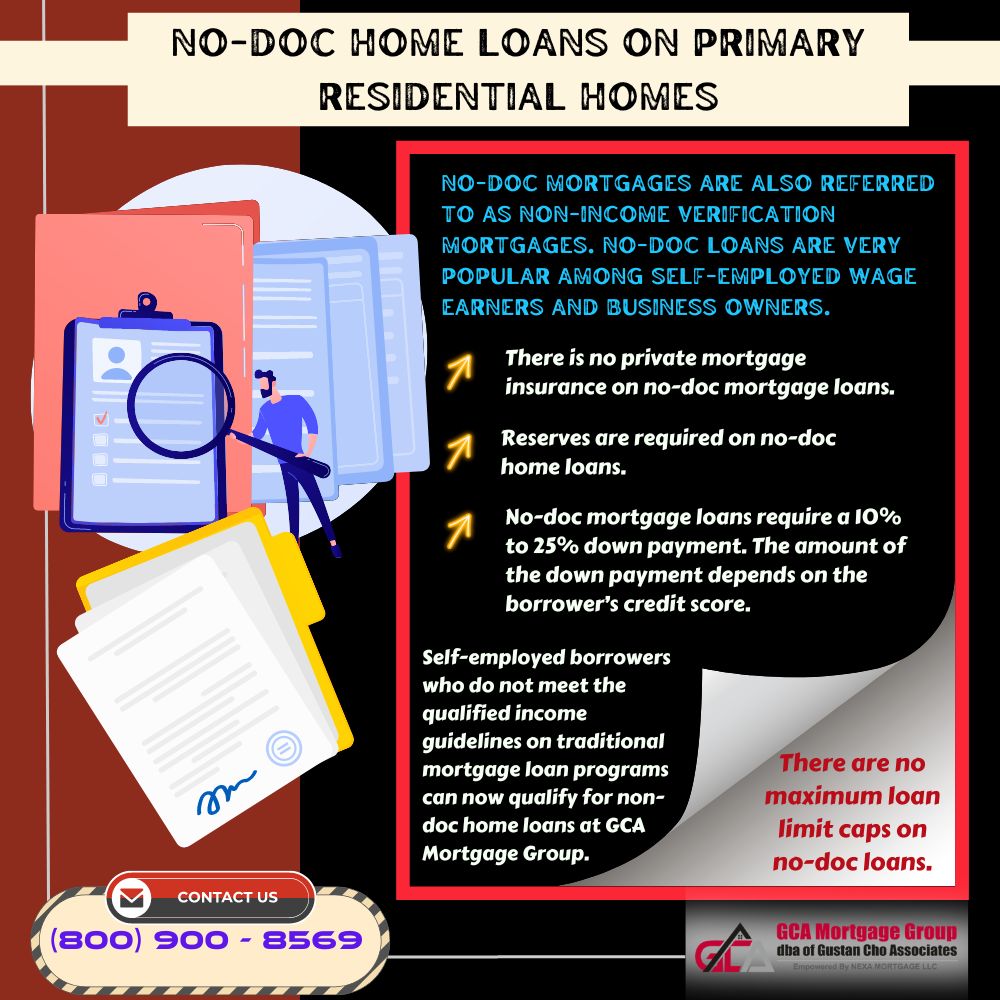

No-doc home loans do not require federal income tax returns, income verification, W2s, 1099s, or other documentation like traditional mortgage loans. No-doc home loans require one month of bank statements showing the down payment and closing costs. The amount of reserves required depends on the borrower’s credit score.

Reserves are required on no-doc home loans. Reserves are one month of principal, interest, tax, and insurance (PITI). There is no private mortgage insurance on no-doc mortgage loans. No no-doc mortgage loans require a 10% to 25% down payment. The amount of the down payment depends on the borrower’s credit score. In the following paragraphs, we will cover no-doc home loans on primary residential homes.

The Emergence of Stated-Income and No-Doc Home Loans

No-doc home loans were discontinued after the 2008 real estate and credit meltdown. No-doc and stated-income mortgages were the mortgage loan of choice before the 2008 financial crisis.

Most real estate industry experts never believed no-doc and stated-income mortgages would resurrect. Now no-doc mortgage loans are becoming the most popular non-QM mortgage loan program in the nation. Many thought no-doc loans would never return.

No-doc mortgages are also referred to as non-income verification mortgages. No-doc loans are very popular among self-employed wage earners and business owners. Many self-employed borrowers and business owners cannot qualify for a mortgage due to not meeting the qualified income requirements.

Benefit Of No-Doc Mortgages For Self-Employed Borrowers

Most self-employed borrowers and business owners have the benefit of being able to write off substantial expenses on their income tax returns. Being able to write off unreimbursed business expenses affects the adjusted gross income.

Mortgage lenders use the adjusted gross income when calculating qualified income on borrowers. Self-employed borrowers have lower adjusted gross income due to the substantial write-off of unreimbursed business expenses.

Homebuyers can now qualify for no-doc home loans for primary residential homes with no income documentation or income tax returns. No-doc home loans do not require income documentation or income tax returns.

Importance of Income Due To The Ability To Repay

Mortgage lenders want to make sure borrowers have the ability to repay their new mortgage loans. One of the safeguards in predicting the ability to repay is the borrower’s income.

The borrower’s past income history is a great predictor of future earners. However, some people have non-traditional income, so lenders will not consider qualified income.

Many self-employed borrowers have substantial unreimbursed expenses where their adjusted gross income is too low to qualify for a mortgage. This is why no-doc home loans were extremely popular before the 2008 real estate and credit meltdown.

No-Doc Home Loans Were The Most Popular Loan Program Before the 2008 Financial Crisis

After the 2008 financial crisis, no-doc home loans were discontinued. The great news is that Gustan Cho Associates is launching non-doc home loans on primary residential homes. Gustan Cho Associates are mortgage bankers, correspondent lenders, and mortgage brokers.

Gustan Cho Associates has lending relationships with dozens of non-QM and alternative wholesale mortgage lenders. This is why we have a national reputation for being a one-stop mortgage lending shop.

If there is any loan program in the market, you can rest assured that Gustan Cho Associates has it. In this article, we will discuss and cover no-doc home loans.

What Are No-Doc Home Loans

No-documentation home loans benefit self-employed borrowers or business owners because they do not require standard income documentation such as W2s and income tax returns.

No-doc loans only require one month of bank statements. Mortgage underwriters will go by bank statement deposits to determine the borrower’s ability to repay. One month bank statement should show the down payment, closing costs, and reserves.

No-documentation mortgages were known as stated-income loans before the 2008 financial crisis because the borrower could state whatever income on the mortgage loan application without the lender verifying it.

No-Doc Loans Benefit Self-Employed Borrowers And Business Owners

Self-employed wage earners or business owners often have hurdles in qualifying for a mortgage due to the inability to document their income. No-doc home loans do not require mortgage borrowers to provide income documentation and very limited asset documentation when qualifying for a home mortgage.

As mentioned earlier, no-doc loans were popular before the 2008 financial crisis.No-doc loans were discontinued after the 2008 real estate crisis until recently.

Gustan Cho Associates offers no-doc home loans on primary home with little documentation required. No-documentation mortgages are easier to process, underwrite, and close due to not requiring income documents and tax returns.

Types of No-Documentation Home Loans

There are several types of no-doc home loans offered at Gustan Cho Associates. The main benefit of no-doc loans is income tax returns and income documentation is not required.

No-doc Home Loans benefit self-employed borrowers or business owners with a substantial write-off on their tax returns or those with little to no adjusted gross income due to large unreimbursed business expenses.

No-doc mortgages do not require any private mortgage insurance. There are no maximum loan limit caps on no-doc loans. In the following paragraphs, we will discuss the most common types of no-doc mortgage loan programs offered at Gustan Cho Associates.

12-Month Bank Statement Mortgages For Self-Employed Borrowers

Bank statement mortgages for self-employed borrowers. The 12-month bank statement loan program for self-employed borrowers requires 12 months of bank statements. Only the monthly deposits are used as the qualifying income. Withdrawals do not count. No income tax returns are required. There are 12 and 24 months bank statement loan programs for self-employed borrowers. The 24-month bank statement loan program has a slightly lower rate than the 12-month loan.

Asset-Depletion Mortgages With No Income Documentation

Asset-Depletion Mortgage Loan Program:

- Asset-depletion mortgage loans are for borrowers who have assets.

- Normally it benefits wealthy individuals without traditional income.

- It is generally calculated based on the borrower’s liquid assets divided by the loan term.

Asset-depletion mortgage loans are ideal for retired high-net-worth borrowers with no traditional income source.

No-Income No-Asset Mortgages

No-Income No-Asset Mortgage Loan Programs:

- No-income no-asset mortgage loans are for investment property loans.

- It is referred to as NINA. NINA is based on the projected rental income for the subject property being financed.

- As long as the rental income covers the income and expenses, no income or asset is required.

- NINA benefits real estate investors who can put a large down payment on investment property but may not have the qualified income and/or assets for traditional financing on an investment property.

No-doc mortgages require good credit and at least a 20% down payment. Mortgage rates are generally higher than traditional mortgages.

No-Doc Mortgage Guidelines and Requirements

There is no doubt no-doc mortgages are going to be extremely popular. The following are the basic requirements and guidelines on no-doc mortgages at Gustan Cho Associates:

- 20% down payment on a home purchase

- No income tax return required

- The minimum credit score required is a 640 FICO

- Bank statements need to be provided

- Reserves required

- The amount of reserves depends on the borrower’s credit score.

To learn more about our no-doc mortgage loan program, contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, on evenings, weekends, and holidays. Gustan Cho Associates dba of Gustan Cho Associates are mortgage bankers, correspondent lenders, and mortgage brokers. We have no lender overlays on government and conventional loans and can broker non-QM and alternative specialty loan programs. We are licensed in multiple states and have a national reputation for being able to do loans other lenders cannot do.