VA Manual Underwriting Guidelines For VA Loans

In this blog, we will cover and discuss the VA manual underwriting guidelines on VA loans. For individuals who have served in the military and are currently on active duty, the VA loan program stands as a powerful tool to facilitate homeownership. VA loans are the best mortgage loan program for owner-occupant primary homes. However, not all mortgage borrowers are eligible to qualify for VA home loans. One of the privileges of being a veteran of the United States Military is active and retired members can become eligible for VA home loans.

Who Qualifies For VA Home Loans?

Active duty, retired veterans, and spouses of deceased veterans with an active certificate of eligibility (COE) can purchase a home with no mortgage insurance, no maximum loan limit, and less-than-perfect credit with 100% financing. Veterans with a certificate of eligibility can apply for a VA home loan at a VA-approved mortgage lender.

Learn More About VA Home Loan With Us

Qualifying for a VA Home Loans

For individuals who are currently serving in the military or veterans who were honorably discharged, more than six years of National Guard or reservist service, the service one must include 90 consecutive days of active service during a war or at least 181 consecutive days of active service during peace, or be a surviving spouse of a service member killed in the line of active duty. In order to qualify for a VA loan, you will need a VA COE (VA Certificate of Eligibility), meet the lenders’ standards for credit and income, and live in the home you are buying.

Do All Mortgage Lenders Offer VA Loans?

What Is The Purpose of The VA Mortgage Loan Program?

One of the frequently asked questions is what is the purpose of the VA mortgage loan program? The main purpose of the VA loan program is to reward the brave men and women of the U.S. Armed Services eligible for a home mortgage loan backed by the United States Department of Veterans Affairs called VA home loans.

VA Loans Information

Get Approved With Your VA Home Loan. Click Here!

What Is The Mortgage Underwriting System on VA Home Loans?

VA Manual Underwriting Guidelines

A veteran is any person who has completed a service for any branch of the armed forces and is honorably discharged. Private lenders issue a VA loan which is partially guaranteed by the Department of Veteran Affairs. This makes the lenders more willing to offer lower interest rates, lower or no down payment, and lower or no closing costs. The VA doesn’t require a down payment, but there is often a funding fee. Sometimes, a disabled veteran can be exempt. VA home loans are designed to help build a home, buy a home or improve a current one. There are also refinancing options available.

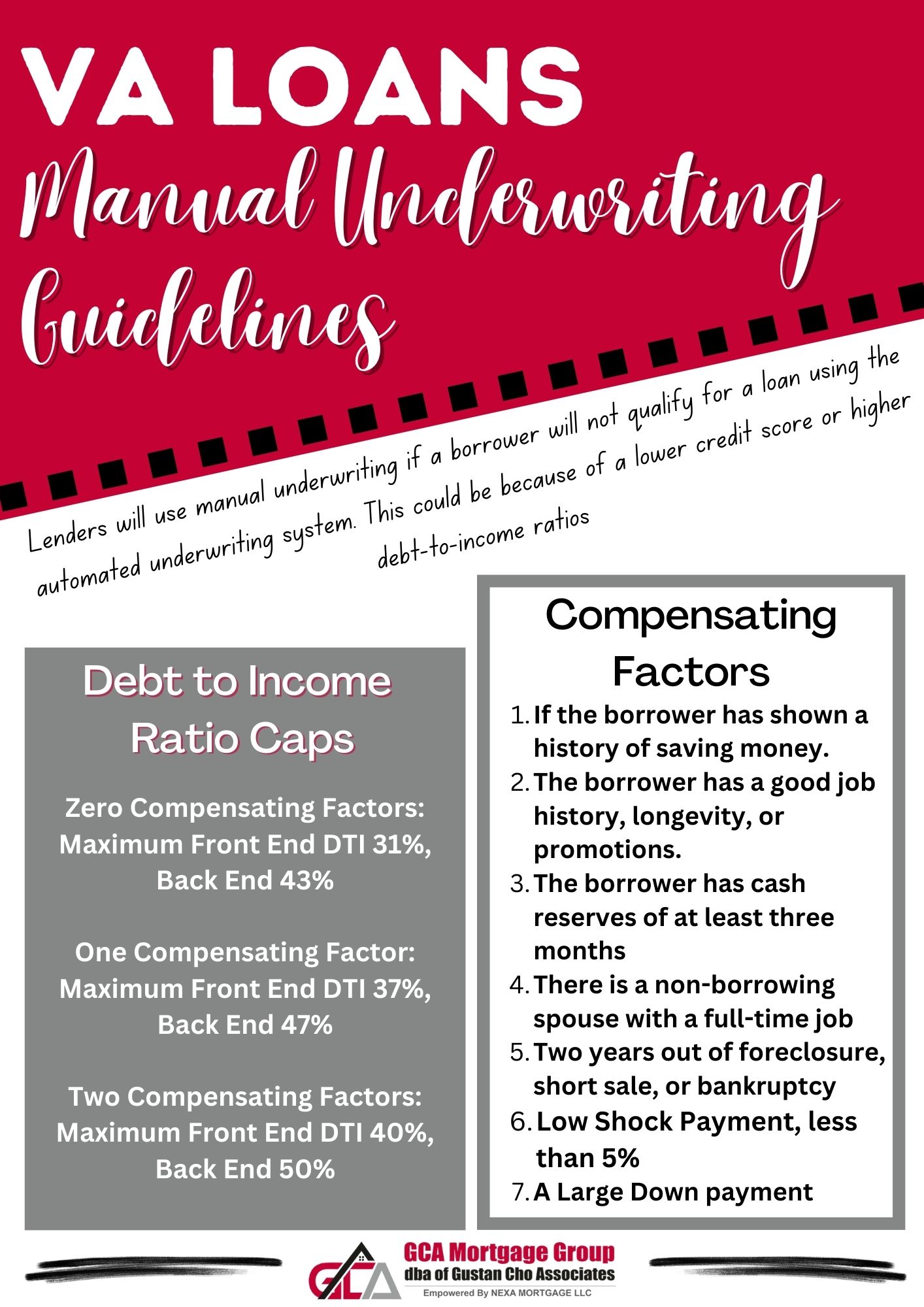

What are Compensating Factors on VA Home Loans?

Compensating factors are positive factors that reduce the lenders’ risk. Below are some examples of compensating factors.

- If the borrower has shown a history of saving money.

- The borrower has a good job history, longevity, or promotions.

- The borrower has cash reserves of at least three months

- There is a non-borrowing spouse with a full-time job

- Two years out of foreclosure, short sale, or bankruptcy

- Low Shock Payment, less than 5%

- A Large Down payment

Debt-to-Income Ratio Manual Underwriting Guidelines

VA manual underwriting guidelines on debt to income ratio caps:

- Zero Compensating Factors: Maximum Front End DTI 31%, Back End 43%

- One Compensating Factor: Maximum Front End DTI 37%, Back End 47%

- Two Compensating Factors: Maximum Front End DTI 40%, Back End 50%

Mortgage underwriters can go above maximum debt-to-income ratio caps for borrowers with multiple compensating factors. This holds especially true for VA loans.

Why Do Mortgage Lenders Use Manual Underwriting?

Lenders will use manual underwriting if a borrower will not qualify for a loan using the automated underwriting system. This could be because of a lower credit score or higher debt-to-income ratios. VA loans utilizing manual underwriting provide essential assistance for veterans and active-duty military personnel encountering distinctive financial situations. By understanding the circumstances that may lead to manual underwriting, the key guidelines, and the steps involved, borrowers can confidently navigate this process. The personalized assessment provided by manual underwriting recognizes the individuality of each borrower’s situation, offering a pathway to homeownership for those who may face challenges with automated systems. Remember, the VA manual underwriting process is designed to be thorough, fair, and focused on providing opportunities for veterans to achieve their homeownership goals.

Frequently Asked Questions (FAQs)

Q: What are VA Manual Underwriting Guidelines?

A: VA Manual Underwriting Guidelines are specific criteria that the VA established for manually underwriting VA loans when automated underwriting systems cannot be used.

Q: When are VA Manual Underwriting Guidelines applied?

A: These guidelines are utilized when automated underwriting systems fail to approve a VA loan application, typically due to low credit scores or complex financial situations.

Q: What factors are considered in VA Manual Underwriting?

A: Manual underwriting assesses various factors, including credit history, income stability, debt-to-income ratio, residual income, and compensating factors such as savings, job stability, and potential for increased earnings.

Q: What minimum credit score is necessary for VA Manual Underwriting?

A: While there’s no minimum credit score requirement, lenders may consider various factors beyond credit scores, emphasizing the borrower’s overall creditworthiness and financial stability.

Q: Can I use VA Manual Underwriting if I don’t meet the automated underwriting criteria?

A: If you need to meet the requirements of automated underwriting, VA Manual Underwriting offers an alternative path for securing a VA loan by allowing lenders to evaluate your application based on VA guidelines manually.

Q: What documents are needed for VA Manual Underwriting?

A: Documents typically include income verification (such as pay stubs or tax returns), bank statements, debt obligations, proof of VA eligibility, and other relevant financial records.

Q: Are there additional requirements for VA Manual Underwriting compared to automated underwriting?

A: VA Manual Underwriting may require more documentation and a more thorough evaluation of the borrower’s financial situation compared to automated underwriting due to the manual assessment process.

Here at Gustan Cho Associates, our Loan Officers are experts when it comes to VA Manual Underwriting Guidelines. Call us now at 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. We are available even during weekends and holidays!

Talk To One Of Our Expert Loan Officer To Guide You Better.