Jumbo Mortgages

In this guide on jumbo mortgages, we will cover what you need to know about jumbo mortgages. When investing in a property, one of the most crucial aspects you have to figure out is identifying how you will finance the investment. Since most people use mortgages, you will have to find the type of mortgage that suits your needs perfectly. You can have a jumbo loan on any type of primary home, second home, and investment property. Borrowers can get financing on single-family homes, hobby farms, condominiums, condotel financing, now-warrantable condos, modular homes, duplexes, and two to four unit multi-family homes.

In this regard, let us tell you about jumbo mortgages, one of the most common mortgages that would help you get that dream property you’ve always wanted.

Learn More About Jumbo Mortgages. Talk to Us.

What Is A Jumbo Home Mortgage?

A jumbo mortgage, or jumbo loan, is a type of financing that goes beyond the conforming loan limits set by the FHFA (Federal Housing Finance Agency). These loans are designed to finance high-end homes and properties in competitive markets. Since they don’t conform to the limits subjected to other conventional mortgages, they come with unique tax implications and underwriting requirements. Also, borrowers seeking this mortgage are subjected to greater scrutiny, and the borrowing costs are a bit higher. However, more and more borrowers nevertheless go with jumbo mortgages to purchase a higher-end home.

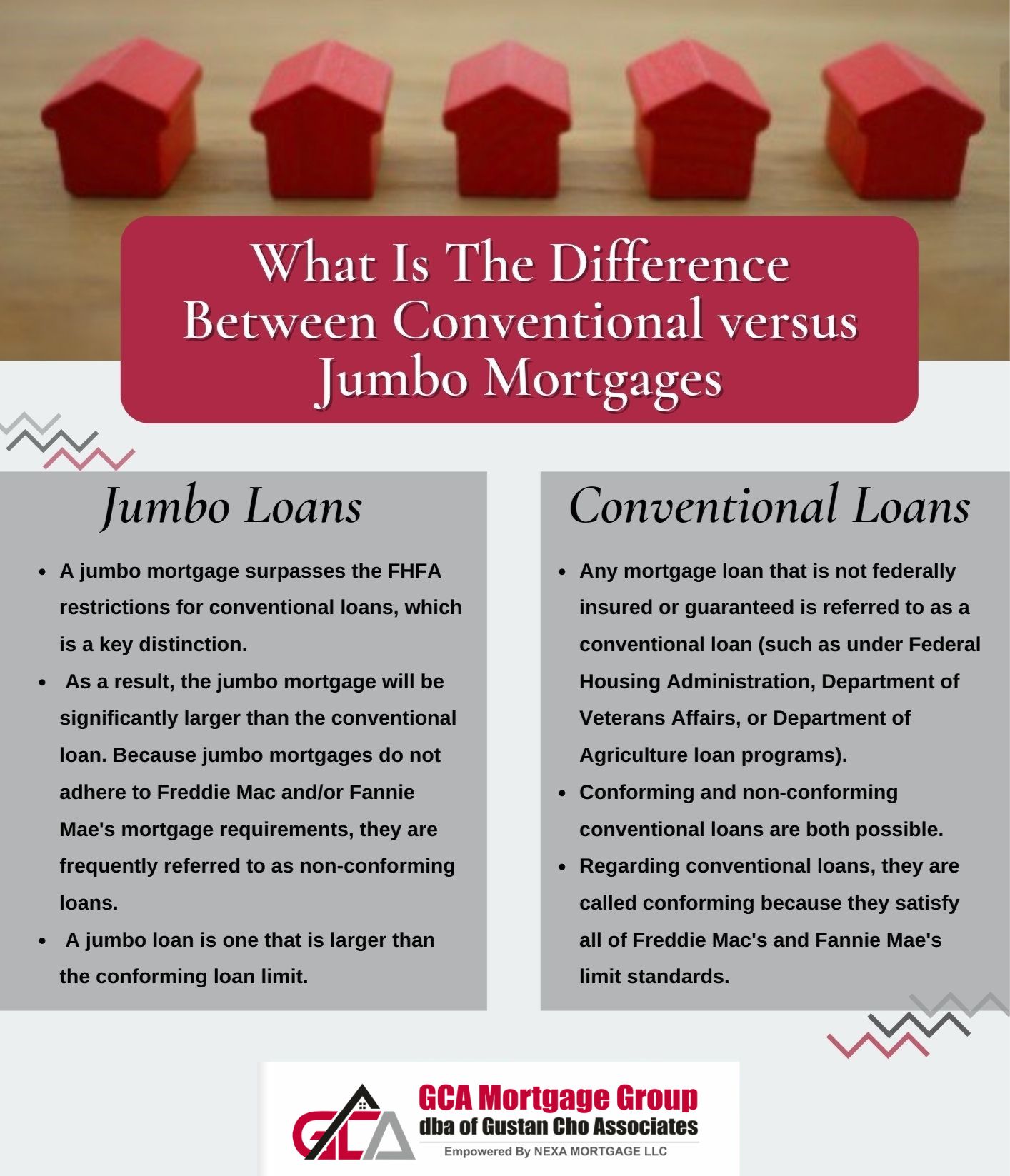

What Is The Difference Between Conventional versus Jumbo Mortgages

As we’ve already mentioned, the critical difference is that a jumbo mortgage exceeds the FHFA limits for conventional loans. This means that the jumbo mortgage will cover so much more than the traditional loan. As for the conventional loan, they meet all the limit requirements by Fannie Mae and Freddie Mac, thereby considered conforming. Jumbo mortgages are commonly referred to as non-conforming loans because they do not conform to Fannie Mae and/or Freddie Mac mortgage guidelines. Any loan size greater than the conforming loan limit is considered a jumbo loan,

What Are The Requirements of a Jumbo Mortgage?

Jumbo mortgages come in various terms and repayment schedules, which is pretty much like conventional loans. Jumbo mortgages are portfolio loans held by financial institutions or sold on the secondary market to private money managers or institutions. Fannie Mae and Freddie Mac will not purchase jumbo loans on the secondary market because they exceeded the maximum conforming loan limit. Each individual mortgage lender will have its own lending requirements on jumbo mortgages. In general, Jumbo loans have stricter requirements than traditional loans. Given that you will have to meet a specific credit score, property type, down payment, and debt-to-income ratio for you to be given one. In the following sections, we will take a look a the various types of jumbo mortgage options you may have.

Prequalify for a Jumbo Mortgage in Just 5 Minutes.

Credit Score Requirements on Jumbo Mortgages

Credit score – Credit scores is a numerical rating that shows a lender how reliable you are, or can be, as a borrower. This is a crucial factor when it comes to jumbo mortgages. The score can range anywhere between 300 and 850. And for the exact score you require to qualify for a jumbo mortgage will most certainly depend on the lender and loan terms.

For a traditional 30-year mortgage, the minimum credit score requirements can vary from 680 to 720 FICO. The minimum credit score requirements are set by the individual mortgage lender. Gustan Cho Associates has non-QM Jumbo loans with credit score requirements down to 550 FICO.

Jumbo Loan Property Guidelines

Property types – there are no restrictions on how you use a jumbo mortgage. Homebuyers can buy and finance any one to four-unit home. It can be used to finance primary residences, investment properties, or vacation homes. So, as long as you have met all the other requirements, the type of property you want to invest in won’t matter.

Jumbo Loan Down Payment Requirements

Down payment – the down payment required for jumbo mortgages is much higher than other conventional loans. Depending on the amount you need and your credit score, you might require payment of up to 20 percent. The down payment requirements are set by each individual mortgage lender of jumbo mortgages. In general, the down payment requirements are normally higher for borrowers with lower credit scores. The down payment for a 550 FICO score borrowers can be 30% down. Higher credit score borrowers can qualify for jumbo mortgages with a 720 credit score.

Jumbo Loan Debt-To-Income Requirements

Debt-to-income (DTI) ratio is the ratio between your income and your debt. Debt-to-income ratios are calculated by dividing your total monthly minimum debt payments. The gross income is used to calculate income. If you are looking for a jumbo mortgage., the team at Gustan Cho Associates can help you with dozens of mortgage options.

We have over 190 wholesale lending partners. Among our lending network, we will strive to get you the very best rates compared to any other mortgage lender. Mortgage underwriters are concerned about borrowers with higher debt-to-income ratios on jumbo mortgages. Gustan Cho Associates has a niche of traditional jumbo lenders that will go up to a 50% debt-to-income ratio.

Are there any special requirements for jumbo mortgages?

The truth is, when the lender feels that there is a greater risk in lending the money, he or she might require some additional requirements, which include:

You Might Be Required To Have Cash Reserves

-

- In addition to checking your DTI ratio, the lender might ask you to provide bank statements to prove that you have money in your account to keep up the payments.

- Depending on the lender, reserves may be required.

- Reserves can range anywhere from one to 12 months of reserves depending on the lender.

- Reserves cannot be gifted

- All reserves need to be borrower’s own funds

Do You Have the Requirements for a Jumbo Loan?

Mortgage Rates and Closing Costs on Jumbo Mortgages

Mortgage rates on jumbo mortgages are generally higher than conforming loans. Mortgage lenders will base the pricing on rates on a jumbo loan based on what type of loan level pricing adjustments (LLPA). LLPAs are pricing hits based on the borrower’s risk factors. Lower credit scores will definitely have a pricing hit on the rate. The costs and fees can be higher on jumbo mortgages versus conforming loans. On average, the closing costs for mortgage loans are between 2 and 6 percent. However, when it comes to high-risk jumbo mortgages, the prices might exceed 6 percent of the total home value.

Consistent income

Other than checking your debt-to-income ratio, the lender might need to know whether your source of income is reliable and regular. So, in this regard, he or she will need documentation proving the income source is unlikely to change for the next three years. Homebuyers who plan on buying their forever retirement home will not be able to qualify for a jumbo mortgage loan if they turn give human resources of their company advance notice on when they will be retiring.

Manual underwriting

All jumbo mortgages are manually underwritten. Borrowers will be required to provide the loan processor with the requested documents required for the processor to have them ready for the mortgage underwriter. All documents that you provide will be checked and verified for validity. All mortgage documents provided to the lender will be thoroughly checked and analyzed by the assigned mortgage underwriter.

The mortgage underwriter is the person who will try to see if there have been any missteps financially in the past. If they see any, you will have difficulty obtaining a mortgage. However, if you meet all the mortgage guidelines as well as the lender’s own internal requirements, you will be issued a conditional mortgage loan approval.

What Loan Size Is Considered Jumbo?

As of January 2022, any mortgage loan that exceeds the conforming loan limit of $647,200 is considered a nonconforming loan since it does not conform to Fannie Mae and Freddie Mac’s guidelines. The maximum loan limit on conforming loans is capped at $647,200. The conforming loan limit was an increase of $98,950 USD from the previous limit of $548,250. Certain counties where home prices are higher than the national median home prices are called high-cost counties. In high-cost areas, the conforming loan limit for 2022 is now at $970,800 on single-family homes.

What Are The Jumbo Loan Mortgage Rates?

The rate of a jumbo mortgage can fluctuate from lender to lender and also from region to region. Jumbo Loans are considered riskier loans. Therefore, due to the risk, lenders charge a higher rate on jumbo mortgage rates. Mortgage rates on jumbo loans are higher than government and conventional loans. Factors that affect pricing on jumbo mortgage rates are the following:

- Credit Scores have the largest impact on pricing mortgage rates on jumbo loans.

- Down Payment and/or LTV have an effect on pricing on jumbo loan mortgage rates.

- Type of property has an impact on pricing jumbo mortgage rates: Condo versus single-family home, etc.

- Primary, second home, and investment home types affect pricing on jumbo mortgage rates.

Who Should Take Out a Jumbo Loan?

The simple answer here is anyone earning between 200k and 550k a year. Since jumbo mortgages are a bit expensive and one is subject to intense scrutiny before obtaining them, you need to be in a high-income earners segment to be considered appropriate. Remember, these people make much money but are not yet rich. They have excellent credit scores and DTI ratios, which is why they are favorites. However, this doesn’t mean that you can’t access a jumbo if you are not in this bracket. You should try, especially if you have met all the other requirements.

Final thought

If you find yourself in a situation where the home, or property, you are looking to buy doesn’t fit within the conventional loan limit, the best decision you can make is to consider a jumbo mortgage. Even though these mortgages are a bit different and require stricter requirements and underwriting processes, they are pretty practical for many people. Contact your mortgage adviser before making any decision to ensure that your decision will be the right one. The team at Gustan Cho Associates are experts in originating and closing traditional and non-QM jumbo mortgages.

Talk to Our Expert Loan Officers. We are Available During Weekends and Holidays.