Purchase

In this guide, we will be covering the home purchase and mortgage process. We will walk you through the steps of buying a home including the home purchase timeline. The steps for purchasing a home include preparing for a mortgage. Two professionals you will be working with on a home purchase are your real estate agent and mortgage loan originator.

In this guide on the home purchase and mortgage process, we will walk you through the overall homebuying process. This is an informative guide for homebuyers, especially first-time homebuyers, on the step-by-step, you will encounter when buying a home. We will explain the overall steps involved and what it takes to the road to owning your very own home.

Learn More on Purchasing a New Home

Steps for Purchasing a Home for Buyers

How does a person decide whether they are ready to purchase a home? It takes much more than a desire to own a home to actually get to the finish line of closing. This is often one of the largest purchases most people will make in their lifetime. Once you have decided you want to be a homeowner, you will have many questions and concerns you want to be answered.

In this guide, we will walk you through the steps in the home purchase and mortgage process. Many first-time homebuyers are under the assumption you need a 20% down payment and great credit to buy a home. This is not true. You can purchase a home with little to no down payment. There are bad credit mortgages for homebuyers with bad credit and lower credit scores. We will cover the home purchase process in the following sections.

Are You Ready To Own Your Own Home?

Initially, you need to determine if you are actually ready to own a home. Is it the right time for you, personally, to jump into home ownership? A buyer needs to consider their lifestyle and wishes. Are you ready to commit to living in one area and one home for the unforeseeable future? If you do decide to move after buying this home, you will need to list and sell the current property. This can be time-consuming. After deciding that you are ready, you need to look at the several key components that lenders will look at.

What Are The Steps In The Mortgage Process?

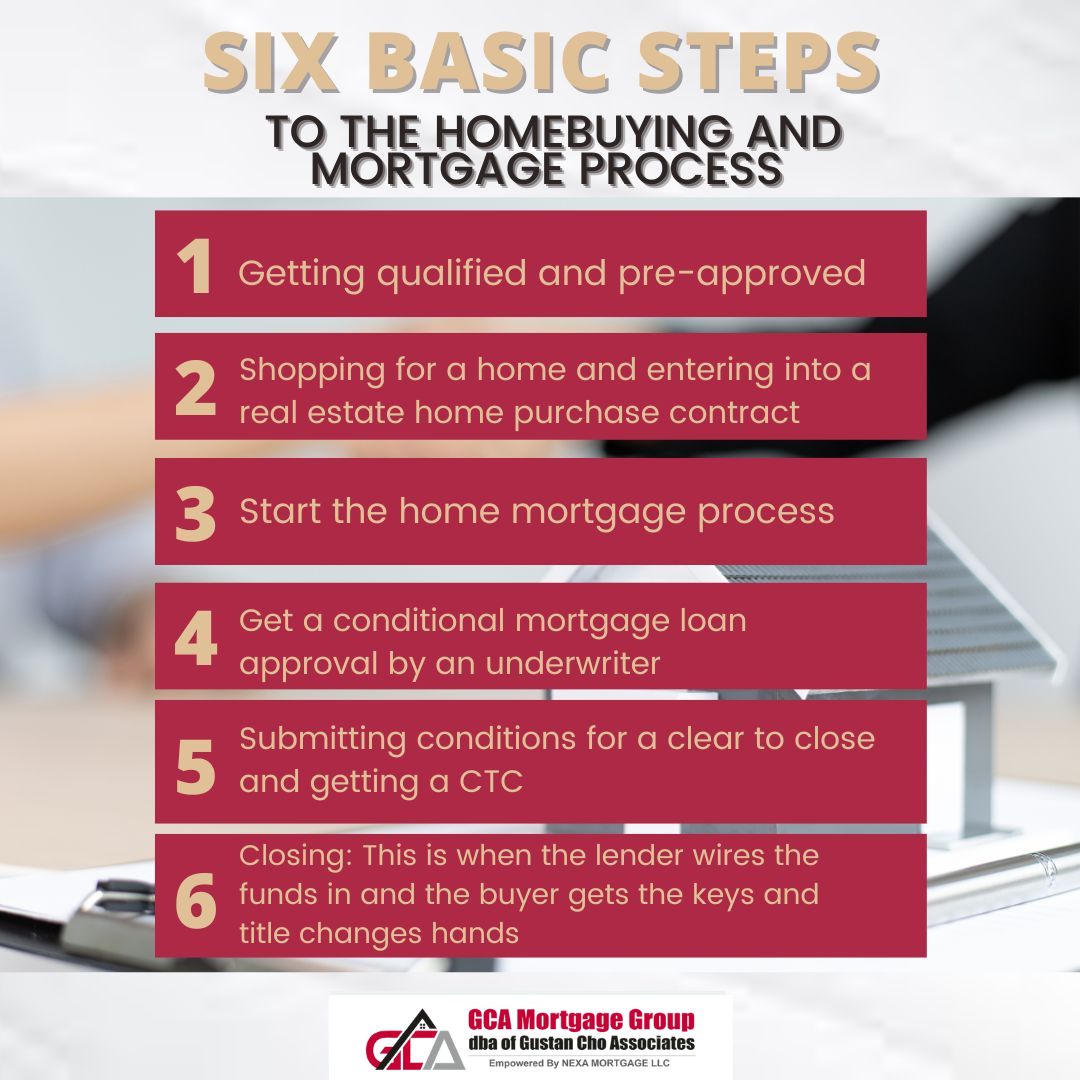

One of the most common frequently asked questions from homebuyers is what are the steps in mortgage process? There are six basic steps to the homebuying and mortgage process:

You need to determine how much home you can afford and still live comfortably. Lenders will look at your credit score and debt-to-income ratio (DTI). They will consider work stability, closing costs, and the ability to make the down payment.

Are You Ready To Own Your New Home?

How Much Do Credit Scores Play an Impact on a Home Purchase?

Your credit score is a numerical culmination report of the types of credit you have used, payment history (Have payments been on time), how you have tried to access new credit, and the amount of money that you owe. The higher the score, the more favorable an individual is to potential lenders. Most lenders look for a credit score of 620 or higher. If you have a score of 720, this will allow for better loan options. You will want to review your credit report prior to applying so that you will be able to dispute any errors and that all information is correct. People can dispute issues on their credit reports, however, it can take months to dissolve any issues.

How Is The Debt-to-Income Ratio Calculated?

The amount of money you owe to debtors compared to what you earn is your DTI. Lenders want to see the likelihood that they will get their money back. How much of your monthly income goes to the debt you owe? These debts include credit card payments, loan payments, and housing expenses. Generally, your housing expenses should be about 30% or less (and no higher than 50%) of what you earn monthly. This will assist you in setting a budget when house hunting.

How Does Income and Employment Affect Mortgage Loan Application?

In the loan process, the lender will want to look at your work history. The key factors in this area that will be considered are consistency and stability in your work history. Has the individual jumped from job to job? Are there gaps in employment? Some lenders look at paystubs from the past 6 months and some look as far back as two years. You will be asked to provide pay stubs and W-2s. If self-employed, you will need to supply other supporting documents and tax returns. They do this to verify your employment, which directly correlates to being able to pay back the loan.

How Much Is The Down Payment and Closing Costs on Home Purchase?

Oftentimes, lenders will not only want to see that you will be able to repay the loan but do you have money for the down payment and closing costs. A down payment is an initial upfront partial payment for a large purchase. The amount of the down payment you will need varies, starting at 3% but vastly depends on loan type and the amount you borrow.

Prequalify For a Mortgage in Just Five Minutes!

How Much Does a Home Purchase Cost?

If a buyer would prefer to avoid private mortgage insurance, the down payment would need to be at least 20% of the mortgage. The closing costs are due before you move into your newly purchased property. These costs vary as well, depending on your loan type and where you live. A general rule is that the closing costs will be between 3-6% of your home’s value. If you are financially able to make a larger down payment, it will benefit you in the long run. The monthly payment and interest rate may be lower.

How Much House Purchase Can You Afford?

Now that you have looked at your finances and determined that you are ready and determined what you can afford, you need to decide what type of mortgage you will be best suited for. There are four main types of home loans. There are Conventional loans, FHA loans, VA loans, and USDA loans. There is a good chance that a buyer can qualify for more than one type of loan so research is key in picking the correct loan type.

What Are Conventional Loans?

Conventional and FHA loans are the two most popular mortgage loan programs in the nation. A Conventional loan is not secured or offered through a government entity. These loans are through banks, mortgage companies, mortgage brokers, and credit unions. There are government-sponsored lenders, such as Fannie Mae, and Freddie Mac. This loan type is common, even though the interest rates are sometimes higher than government-backed loans. Conventional loans tend to have stricter eligibility requirements and higher down payment requirements.

What Is An FHA Loan?

An FHA loan is a government-backed home loan program through the U.S. Housing and Urban Development (HUD). HUD is the parent of the Federal Housing Administration. This financing allows homebuyers to have lower down payments, as low as 3.5%. Lenders are more than willing to offer homebuyers FHA loans with a 3.5% down payment at competitive rates with lenient lending guidelines due to the government guarantee by HUD.

If homeowner defaults on an FHA loan, the lender will be limited on the loss due to being insured by the Federal Housing Administration. FHA loans are considered low risk by lenders as the government has insured them. These types of loans are popular choices for individuals with lower credit scores and people who have gone through bankruptcy or home foreclosures.

What Are VA Loans?

VA loans are the best home loan program in the nation. However, only eligible active and retired veterans are eligible for VA loans. Private lenders who are VA-approved can originate and fund VA loans. Due to the government guarantee by the Veterans Administration, lenders can offer VA loans with no down payment with 100% financing, no mortgage insurance, and competitive rates.

A VA loan is a mortgage loan guaranteed by the United States Department of Veterans Affairs. A VA loan is available for qualified Veterans, service members, and surviving spouses. These loans are still made by private lenders (banks and mortgage companies).

What Are USDA Loans?

A USDA loan assists people in rural and suburban areas. This is a government-backed loan that you can get 0% down with, however, the intended home purchase has to be in a rural area and you have to meet the income eligibility guidelines.

A buyer will also need to consider if the interest rate is fixed or variable. Fixed rates are exactly what they sound like- the mortgage payment remains the same throughout the life of the loan. A variable rate will most likely be less expensive during the initial phases of the loan but it could increase multiple times throughout the life of the loan, based on the current market.

Click Here to Check What Type of Loan Fits You

Pre Approval and Real Estate Agents

In order to be able to shop for homes and enter into a real estate purchase contract, you need to get qualified and pre-approved. The first step in getting qualified and pre-approved for a mortgage is to consult with a loan officer. You can get referred to a loan officer through family, friends, colleagues, and real estate agents, or you can choose a loan officer of your choice by doing your own research.

It is best to get qualified and pre-approved for a mortgage when deciding to purchase a home as soon as you can. By doing so, you can pull the trigger anytime you see the home of your dreams. A pre-approval has no expiration date. As long as your income and expenses remain stable, your pre-approval should be good indefinitely.

How To Get Pre-Approved So You Can Shop For Homes?

This is done by applying with your chosen lender. After the approval process, which includes a review of your credit, assets, and income, you receive a pre-approval letter that will help you find homes within your budget. At this point, you need to find a real estate agent. Although you can buy a home without a real estate agent, having one ensures that you have an advocate and someone to help you navigate the entire process.

A real estate agent will help you find a home that fits your needs, book showings to look at houses, and submit offers. They are knowledgeable about what is a fair price for each home and help you decide on what to offer. Oftentimes when making an offer, it will be declined or you will receive a counter offer. A real estate agent can assist you in remaining calm and unemotional during these times so that you can make the best-educated decision.

Looking for Your New Home

At this point in the process, you have probably looked at listings online and may have even found a home that you would like to see through family, friends, or social networks. In order to make the best decision, you should already have some idea of what is important to you and what you are looking for.

Some items to consider are the area where the home is located, schools, community culture, and the physical layout of the home. Does it check off the boxes of your priorities? For example, if you need a home office, does it have the space? Does it have a yard, if that is important to you? What is the price and how much work does it need?

Time to Make an Offer

Once you find the home you have been looking for, it’s time to make an offer. This is where having a real estate agent really pays off. The agent will write the offer letter and submit it to you after discussing whether to submit for the asking price, below the asking price, or above the asking price, which is sometimes done to help secure the offer. The seller will respond by the given deadline by accepting the offer, rejecting the offer, or giving a counteroffer.

Negotiating Home Purchase Price

Obviously, potential buyers will hope for acceptance but it is not always the end of the road if the offer is rejected. Negotiations can go back and forth for some time. If your negotiations paid off and the offer has been accepted, it is now time to get a home inspection and a home appraisal. A home inspection is done by a professional and is sometimes required prior to buying. It is advised that a home inspection is completed regardless of requirements to protect the buyer.

Home Inspection

A home inspector will send a report and the buyer should look for major issues that should be corrected prior to buying. A home appraisal is required prior to buying and is done to ensure that the lenders are not loaning out more money than the home is worth. If the buyers are worried that the appraisal will be too low, they can require an appraisal contingency.

A low home appraisal allows the buyer to stop the process or offer a lower price. This may be necessary in order to get the proper financing. Once you receive and review the inspection and appraisal results, you can ask for repairs, ask for credits toward closing, or a discounted price if the appraisal is low.

Final Walkthrough and Prior To Closing

Prior to closing, there is a final walk-through. This is done to be positive that the seller has completed any requested repairs or tasks found during the inspection. This is a good time to ensure that all final requests are done. Did the seller leave anything at the home? Are there any new issues that were not noted previously?

Once the final walk-through has been completed and the buyers are satisfied, it is now time for CLOSING! At least three days prior to the closing, the lender is required to send you a closing disclosure. This form lists all the final details for the purchase such as closing costs, and details of who pays what.

Home Closing

The buyer should ensure that everything was calculated correctly. The meeting will normally be at the office of the escrow (usually the title company). At the closing meeting, you will need your photo ID, any documents you were instructed to bring for the title company or mortgage officer, and a certified or cashier check made payable to the title or closing company for costs that are not being deducted from the sales price. You will sign a mountain of documents for what seems like all of eternity. After you have signed all the required documents, you will be a new homeowner and receive your keys! Congratulations! You are now a homeowner.

Frequently Asked Questions (FAQs)

- How do I start the process of buying a home? Begin by assessing your financial situation, getting pre-approved for a mortgage, and hiring a real estate agent.

- What is a down payment, and how much do I need? A down payment is the initial amount you pay toward the home’s purchase price. The amount varies but is typically 3-20% of the home’s price.

- What is a mortgage, and how does it work? A mortgage is a loan used to buy a home. You repay it in installments, including interest, over a set period, usually 15-30 years.

- What is a fixed-rate vs. adjustable-rate mortgage (ARM)? A fixed-rate mortgage has a constant interest rate, while an ARM’s rate can change periodically, affecting your monthly payments.

- What are closing costs, and who pays them? Closing costs are fees associated with the home purchase, paid by both the buyer and seller. They include fees for inspections, appraisals, and more.

- What’s the importance of a home inspection? A home inspection helps identify potential issues with the property, ensuring you make an informed decision and can negotiate repairs with the seller.

- What is a real estate appraisal, and why is it necessary? An appraisal assesses the home’s value to ensure it’s worth the agreed-upon sale price and is often required by lenders.

- How do I make an offer on a home? Work with your real estate agent to draft an offer, including the purchase price, contingencies, and other terms, which will be presented to the seller.

- What is escrow, and how does it work in a home purchase? Escrow is a neutral account where funds are held during the home buying process, ensuring both parties fulfill their obligations before the sale is finalized.

- What happens at the closing of a home purchase? At closing, all parties sign the necessary documents, and ownership of the property is transferred to the buyer, who pays the remaining costs and receives the keys.

Start your mortgage journey with us. You can contact us at Gustan Cho Associates by calling us at 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays! Click Here for free quote for your loan