FHA Guidelines on Income and Employment Gaps

This blog will discuss and cover FHA guidelines on income and employment gaps. We will detail the FHA guidelines on income and employment gaps for homebuyers. Homebuyers do not need to be employed in the same job for the past two years to qualify for FHA loans. FHA guidelines on income and employment gaps for home buyers were released in January 2023 under HUD’s FHA 4000.1 Handbook.

FHA loans is the most popular mortgage loan program for first-time homebuyers, borrowers with bad credit, borrowers with low credit scores, homebuyers with outstanding collections and charge-off accounts, and borrowers with high debt-to-income ratio.

On traditional mortgage loans such as FHA, VA, USDA, and conventional loans, the borrower’s employment history and qualified income is one of the most important factors for a mortgage underwriter to issue a mortgage loan approval. In the following paragraphs, we will be covering FHA guidelines on income and employment gaps.

How Much Work History Do You Need For an FHA Loan?

HUD requires two years of employment history and two years of residential history. HUD’s two-year employment history requirement does not mean that a borrower needs to be employed with the same employer for two straight years.

Gaps in employment have been permitted in the past two years. Unfortunately, most mortgage lenders have mortgage lender overlays. Overlays are lending requirements above and behind those of minimum HUD Guidelines imposed by individual lenders.

Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans.

Can You Qualify For a Mortgage With Employment Gaps in the Past 2 Years?

They require two years of employment history with the same employer and no employment gaps in the past two years as part of their lender overlays. Borrowers who are told they do not qualify for an FHA Loan due to employment gaps, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

Gustan Cho Associates no FHA lender overlays on FHA loans. Gustan Cho Associates has no overlays on government and conventional loans. Borrowers with multiple gaps in employment can qualify for FHA home loans.

In the following paragraphs, we will go over the qualification requirements to qualify for a mortgage with gaps in employment in the past two years.

How Many Job Changes In The Past Two Years Does FHA Allow?

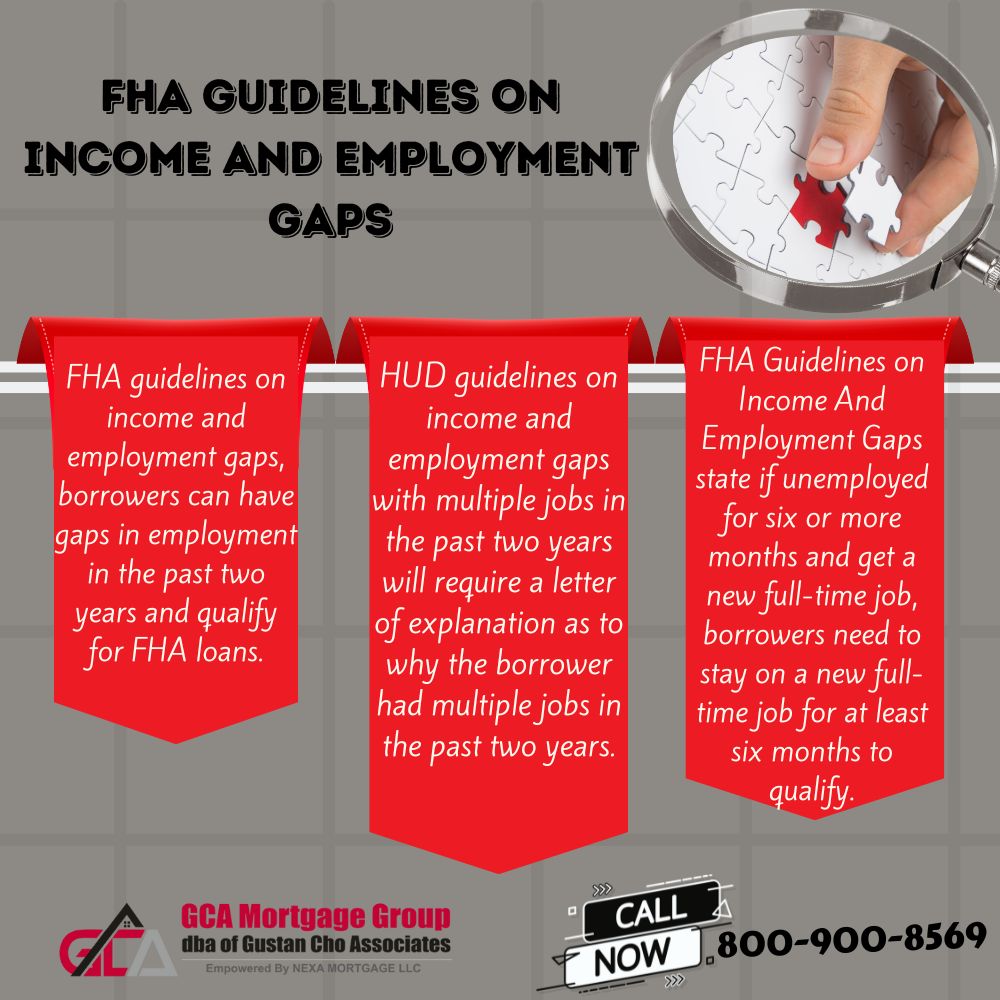

FHA Guidelines on Income And Employment Gaps state if unemployed for six or more months and get a new full-time job, borrowers need to stay on a new full-time job for at least six months to qualify. Mortgage applicants do need two years of employment history. But the two years of employment history does not need to be continuous.

Lenders like to see mortgage loan borrowers in the same job for the past two years, but that is not an FHA guideline. If they have changed jobs, they would like for them to be in the same field for the past two years. However, being in the same field with changing jobs is not an FHA Guideline. That call is up to the mortgage underwriter’s discretion.

If the mortgage loan borrower has had a change in employment within the past six months and got a new full-time job before the six months gap in employment requirement, there is no seasoning requirement for a new full-time job. Can qualify for an FHA loan with a job offer employment letter. But cannot close on their FHA loan until they can provide 30 days of paycheck stubs.

FHA Job Gap Requirements

HUD guidelines on income and employment gaps with multiple jobs in the past two years will require a letter of explanation as to why the borrower had multiple jobs in the past two years. If it is the case of one better job offer after another due to the worker’s talent and higher income opportunities, it is perfectly acceptable. However, mortgage loan underwriters will question why a borrower would have multiple jobs in the past two years.

How Many Jobs Can You Have In The Past Two Years For an FHA Loan?

HUD has no rule that a borrower with multiple jobs in the past two years cannot qualify.

Mortgage underwriters can use the underwriter’s discretion in denying a loan applicant with multiple jobs in the past two years. This is especially if the borrower has jobs that have declining incomes and fewer hours of employment.

Underwriters need to feel comfortable that the new full-time job and income will likely continue for the next three years. Again, this is a case-by-case matter and ultimately will rely on the mortgage underwriter’s discretion.

Can I Get an FHA Loan If I Just Started New Job?

Per FHA guidelines on income and employment gaps, borrowers can have gaps in employment in the past two years and qualify for FHA loans. Homebuyers and Homeowners who need a national mortgage broker with no overlays on government and conventional loans, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, on evenings, weekends, and holidays.