High Debt-To-Income Ratio Mortgage Solutions

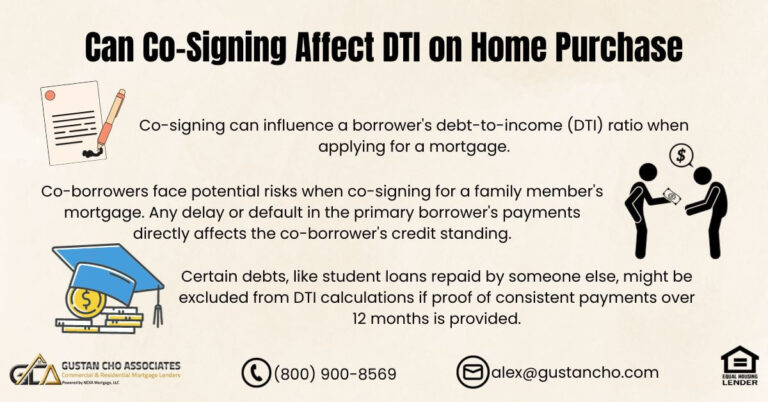

This guide covers high debt-to-income ratio mortgage solutions for borrowers. Debt-to-income ratio and credit is the two most important factors in the mortgage approval process. The debt-to-income ratio is calculated by adding the total minimum monthly payments and dividing it by the mortgage borrower’s monthly gross income. For example, let’s take a case study on…