VA Loan With High DTI Mortgage Guidelines For 2023

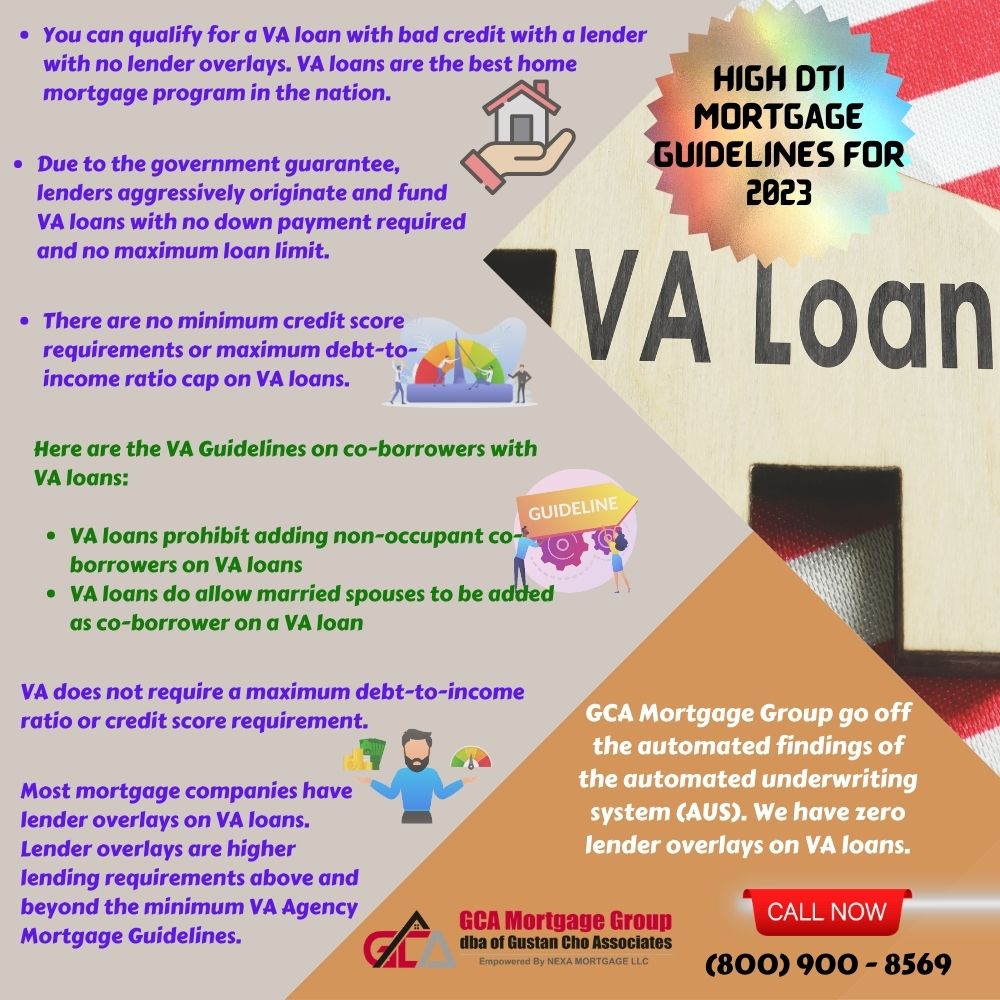

This blog will discuss VA loan with high DTI mortgage guidelines for 2023. You can qualify for a VA loan with bad credit with a lender with no lender overlays. VA loans are the best home mortgage program in the nation.

Lenders can offer 100% financing with no down payment required at lower mortgage rates than conventional loans with no mortgage insurance on VA loans due to the government guarantee. The U.S. Veterans Affairs is the government agency that governs VA loans.

VA will partially guarantee and insure lenders if borrowers default and foreclose on VA loans. The Veterans Administration has the most lenient mortgage guidelines over any other traditional conforming loan programs. You can have prior bad credit, low credit scores, bad credit scores, outstanding collections, and charge-off accounts, and high debt-to-income ratios and qualify for VA loans. However, you cannot have late payments in the past 12 months and get approved for VA loans. In the following paragraphs, we will cover qualifying for a VA loan with high DTI mortgage guidelines for 2023.

Why VA Loans are the Best Mortgage Program

Due to the government guarantee, lenders aggressively originate and fund VA loans with no down payment required and no maximum loan limit. There are no minimum credit score requirements or maximum debt-to-income ratio cap on VA loans. The team at Gustan Cho Associates has zero lender overlays on VA loans.

VA loans have more lenient mortgage guidelines than other government loan programs. For example, the waiting period requirement after bankruptcy, foreclosure, a deed in lieu of foreclosure, or a short sale is two years on VA loans versus three years on FHA and USDA loans.

All lenders must ensure all their borrowers meet the minimum VA Agency Guidelines. The team at Gustan Cho Associates has helped thousands of Veterans with credit scores down to 500 FICO get approved for VA loans.

Lender Overlays on VA Loans

Most mortgage companies have lender overlays on VA loans. Lender overlays are higher lending requirements above and beyond the minimum VA Agency Mortgage Guidelines.

Gustan Cho Associates is one of the few mortgage companies licensed in multiple states with no lender overlays on VA loans. Over 75% of our borrowers at Gustan Cho Associates could not qualify at other lenders due to their lender overlays.

Gustan Cho Associates go off the automated findings of the automated underwriting system (AUS). We have zero lender overlays on VA loans.

VA Agency Guidelines Versus Lender Overlays

Lenders tell many home buyers that they do not qualify for a VA loan with high DTI. This holds even though borrowers get an approve/eligible per the automated underwriting system (AUS).

VA does not have debt-to-income ratio requirements. They are told that they do not qualify for a VA loan with high DTI because it is a VA Guidelines on Debt to Income Ratio but because it is the lender’s own lender overlays.

Gustan Cho Associates has no overlays on VA home loans. We do not have any minimum credit score requirements. Gustan Cho Associates has no maximum debt-to-income ratio caps. All we go by is the automated findings of the Automated Underwriting System. In this article, we will discuss and cover qualifying for a VA loan with high debt-to-income ratios.

What Are Lenders Overlays On VA Home Loans

Overlays can be explained as follows. The United States Department of Veteran Affairs, VA, is not a lender.

VA is a government agency that guarantees and insures lenders in the event borrower default and foreclosures on VA loans. For VA to insure a home loan, the lender must follow minimum VA Mortgage Lending Guidelines. VA does not have a minimum credit score nor a debt-to-income ratio requirement.

As long as the Veteran borrower can get an approve/eligible per the Automated Underwriting System, VA will insure and guarantee loans. However, most lenders have overlays on VA loans. Overlays on VA loans are additional requirements that the lender will impose on top of the minimum VA Guidelines.

VA Agency Guidelines Versus Lender Overlays

For example, if a Veteran gets an approve/eligible per AUS FINDINGS with a credit score of 550 FICO and a 60% debt-to-income ratio, there is no reason why a lender cannot get this borrower approved and get their VA loan closed. But the lender can say no. Lenders can impose a higher credit score requirement. For example, if borrowers have a 580 credit score with an AUS Approval, lenders can require a 640 FICO due to their overlays.

Debt-to-Income Ratio Lender Overlays on VA Loans

The lender can also set a maximum debt-to-income ratio requirement, such as not greater than 41% debt-to-income ratio. VA does not require the Veteran borrower to pay off outstanding collection accounts and charge off accounts to get an approved/eligible per Automated Underwriting System.

VA loans have no minimum credit score requirements and no maximum debt-to-income ratio cap. The minimum credit score requirements by lenders and maximum debt-to-income ratio cap are set by the individual lender and not from the Veterans Administration. Gustan Cho Associates has no lender overlays on VA loans.

A lender can have overlays. Lenders can require borrowers to pay off all collections and charge off accounts. If you are told that you do not qualify for a VA loan, please contact Gustan Cho Associates. We do not have any overlays on VA loans. This holds as long as borrowers can get automated approval per AUS FINDINGS. VA does have a residual income requirement.

Adding Co-Borrowers To Resolve VA Loan With High DTI

Gustan Cho Associates specializes in helping borrowers qualify for VA loan with high DTI. VA has different requirements for non-occupant co-borrowers and co-borrowers on VA than FHA loans. With FHA loans, here are the requirements for co-borrowers. Can add a non-occupant co-borrower or co-borrowers on FHA loans. Non-occupant co-borrowers must be related to the borrower by law, marriage, or blood for FHA loans.

VA Guidelines on Co-Borrowers

Here are the VA Guidelines on co-borrowers with VA loans:

- VA loans prohibit adding non-occupant co-borrowers on VA loans

- VA loans do allow married spouses to be added as co-borrower on a VA loan

How Is Debt-To-Income Ratio on VA Loans Calculated

Debt-to- income ratio is calculated as follows by lenders.DTI, or debt-to-income ratio, is the sum of all the borrower’s minimum monthly payments divided by the borrower’s monthly gross income. Monthly debts that are calculated are the debts that only report on the borrower’s credit report, such as the following:

- minimum credit card payments

- minimum monthly installment loan payments

- auto payments

- student loan payments

- child support payments

- alimony payments

- monthly payment agreements on tax liens, judgments, or other large debts with payment agreements

- PLUS the proposed principal, interest, taxes, insurance (P.I.T.I.) of the proposed home purchase

Gross income is the only qualified income that can be documented, and cash income does not count. Then, divide the sum of all monthly debts by the borrower’s monthly gross qualified income. That yields the debt-to-income ratio. Monthly debts that are not included are the following:

- utilities

- car insurance

- health insurance

- child care

- or any other debts that do not report to credit bureaus and are not on the credit report

Getting Pre-Approved For VA Loan With High DTI and No Overlays

VA does not require a maximum debt-to-income ratio or credit score requirement. Borrowers said they do not qualify for a VA loan with high DTI or overlays on VA loans. Don’t hesitate to contact us at Gustan Cho Associates at 800-900-8569 or text for a faster response. Or email us at gcho@gustancho.com.

Over 80% of our borrowers at Gustan Cho Associates are folks who could not qualify at other mortgage companies. The team at Gustan Cho Associates have a national reputation of being able to do mortgage loans other lenders cannot do.

The team at Gustan Cho Associates are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. Our support and licensed personnel at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays. We do not have any overlays on VA loans. Gustan Cho Associates has no minimum credit score requirements or maximum debt-to-income ratio caps on VA loans.