Manual Underwriting Guidelines With Late Payments

This Article Is About Manual Underwriting Guidelines With Late Payments:

FHA and VA loans are the only two mortgage loan programs that allow for manual underwriting. Manual underwriting is when a borrower cannot get an approve/eligible per automated underwriting system. The file needs to be manually underwritten to a human underwriter. The borrower’s file is manually underwritten by a human underwriter and is considered a riskier loan.

There are additional lending guidelines on manual underwriting files. Debt to income ratio caps is lower than AUS-approved files. Gustan Cho Associates is one of the nation’s most aggressive lenders on manual underwrites. Gustan Cho Associates can approve manual underwrites with late payments in the past 12 months. Sometimes, we can qualify for VA and FHA manual underwrites with late payments in the past 12 months. However, the borrower will need strong compensating factors.

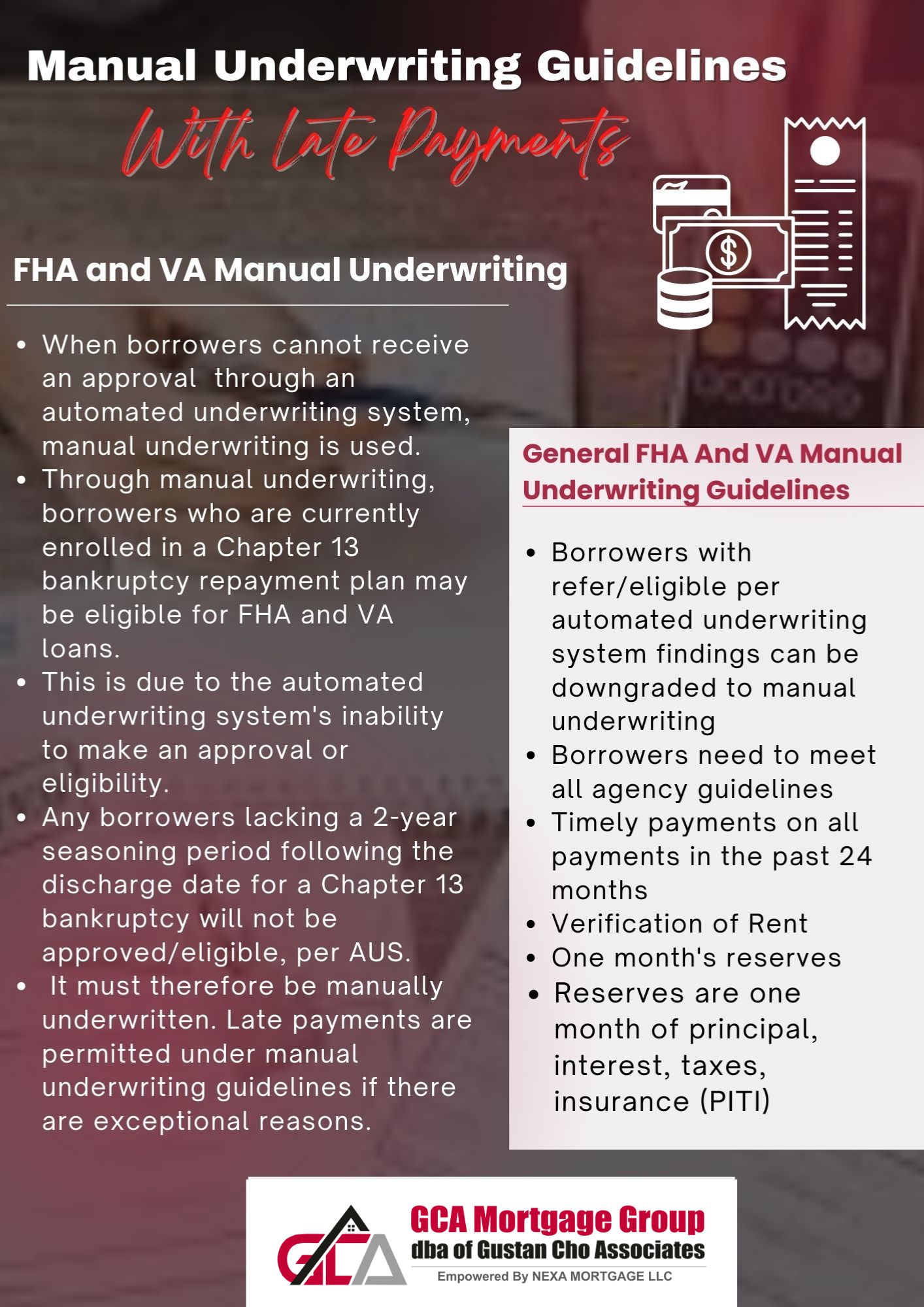

FHA and VA Manual Underwriting

FHA and VA Loans allow manual underwriting.

Manual Underwriting is when borrowers cannot get an approve/eligible per automated underwriting system. Borrowers who are in an active Chapter 13 Bankruptcy Repayment plan can qualify for FHA and VA Loans via manual underwriting.

This is because the automated underwriting system will not render an approve/eligible It will render a refer/eligible. There is no waiting period after the Chapter 13 Bankruptcy discharged date on FHA and/or VA Loans

Any borrowers without a 2-year seasoning after the Chapter 13 Bankruptcy discharged date will not get an approve/eligible per AUS. Therefore, it needs to be manually underwritten. Manual Underwriting Guidelines, Late Payments is allowed with extenuating circumstances. In this blog, we will discuss getting approved for FHA and VA Loans Manual Underwriting Guidelines.

Per Manual Guidelines With Late Payments, it is possible to get approved for FHA and VA Home Loans with manual underwriting with late payments due to extenuating circumstances. However, it is next to impossible to get any mortgage underwriter to approve a mortgage with late payments in the past 12 months.

General FHA And VA Manual Underwriting Guidelines

FHA and VA Loans are the only two loan programs that will accept manual underwriting. Both FHA and VA manual underwriting guidelines are the same.

Here are the general FHA and VA Manual Underwriting Guidelines:

- Borrowers with refer/eligible per automated underwriting system findings can be downgraded to manual underwriting

- Borrowers need to meet all agency guidelines

- Timely payments on all payments in the past 24 months

- Verification of Rent

- One month’s reserves

- Reserves are one month of principal, interest, taxes, insurance (PITI)

Having timely active credit tradelines is important for manual underwriting. If you have had late payments in the past 24 months, it is key that you have active timely credit tradelines. Strong reserves and savings will help borrowers with late payments in the past 24 months. Lenders want to see strong savings for borrowers with late payments and prior bad credit. Outstanding collection and charged-off accounts do not have to be paid.

Manual Underwriting Guidelines With Late Payments On VA And FHA Loans

Late payments in the past 24 months are an automatic disqualification with manual underwriting by most lenders. Per Manual Underwriting Guidelines With Late Payments, borrowers are allowed late payment in the past 24 months with manual underwriting if they had extenuating circumstances.

Even though per Manual Underwriting Guidelines With Late Payments, late payments are allowed, more than 99% of the lenders will not want to touch it.

Great News.

Gustan Cho Associates are national lenders with no overlays on government and conventional loans. We have done countless manual underwriting with late payments in the past 24 months on FHA and VA Loans.

This is not a guarantee. Borrowers need to have extenuating circumstances and supporting documents. Our loan officers will help borrowers write a good letter of explanation concerning the extenuating circumstances.

What Are Extenuating Circumstances?

Extenuating Circumstances are hardships in one’s life that caused an interruption in steady income. Due to this hardship, borrowers had a loss of income. Therefore, they were late on their monthly debt and affected their credit. Divorce is not an extenuating circumstance. National disasters such as a tornado, hurricane, wildfires, floods, and other Presidential Declared Disasters are considered as an extenuating circumstance.

Death, a major illness, and loss of a job are considered extenuating circumstances. To use extenuating circumstances as a reason for late payments in the past 24 months, borrowers need to provide supporting documents and a letter of explanation. For more information, contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.