Mortgage Overlays Explained on Government and Conventional Loans

This article will cover mortgage overlays on FHA, VA, and conventional loans. The two most common home mortgage programs are government and conventional loans. Lenders must ensure borrowers meet the minimum agency mortgage guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac.

Borrowers should understand the mortgage overlays on FHA, VA, and Conventional loans. Why is it that the Veterans Administration does not have a minimum credit score requirement but most lenders require a 62o to 640 credit score? This is because most lenders have mortgage overlays on VA loans.

Lenders can have higher lending requirements above and beyond agency mortgage guidelines called mortgage overlays. Most lenders have mortgage overlays on just about anything. The following paragraphs will thoroughly discuss the typical mortgage overlays on government and conventional loans.

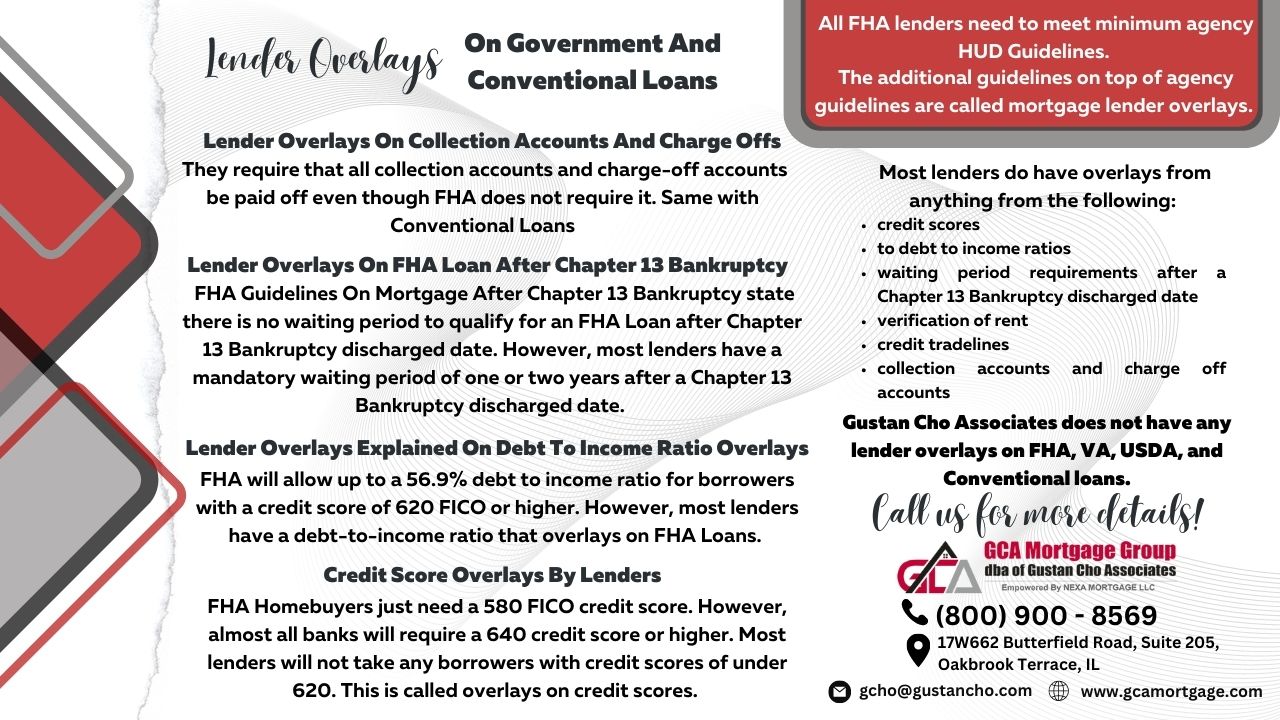

Common FHA, VA, and Conventional Mortgage Overlays

Common mortgage overlays imposed by lenders are credit scores, debt-to-income ratio, collections/charged-off accounts, gift funds, reserves, and other factors lenders consider high risk. For example, HUD and VA allow manual underwriting. However, some lenders may not allow manual underwriting because they may not want to take on the added risk. It is perfectly legal for lenders to have mortgage overlays. Most lenders have mortgage overlays on government and conventional loans. Gustan Cho Associates has no mortgage overlays on FHA, VA, USDA, and Conventional loans.

Government-Backed Home Mortgages

There are qualification requirements that are required by mortgage borrowers in order for them to qualify for mortgage loans. Each mortgage loan program has its own mortgage lending guidelines called agency guidelines. There are several types of mortgage loan programs.

Government Loans are the following:

- FHA Loans

- VA Loans

- USDA Loans

The above three loan programs are called government-backed mortgages. They are called government loans because of the government guarantee lenders get in the event borrowers default. If a borrower defaults on a government loan, the government agency will insure and/or partially guarantee the lender against the loss sustained by the lender. However, lenders need to make sure they follow the agency mortgage guidelines on the government loans they originate and fund.

Conventional Versus Government Mortgages

Any government agency does not guarantee conventional loans. However, they need to conform for Fannie Mae and Freddie Mac to purchase these loans from lenders. Conventional Loans are called conforming loans because they need to Conform To Fannie Mae and Freddie Mac Guidelines.

FHA loans are backed by the U.S. Department of Housing and Urban Development, commonly referred to as HUD. HUD, is the parent of HUD. Conventional loans are not backed by any government agency.

Each one of these mortgage loan programs has its mortgage lending requirements. We will discuss FHA loans and Conventional Loans in this blog because these two mortgage loan programs are the most popular mortgage loan programs today in the United States.

Mortgage Overlays on FHA Home Loans

The United States Department of Housing and Urban Development, often known as HUD by many, is the parent of FHA or the Federal Housing Administration. FHA is not a mortgage lender. It is a governmental agency insures mortgage loans to lenders who follow and meet all FHA mortgage guidelines. For HUD to insure an FHA loan against borrower default, lenders need to HUD-Approved.

In order for HUD to partially guarantee and insure lenders FHA loans that homeowners defaulted, the FHA loan needs to have met all the minimum HUD agency guidelines. If the loan did not meet the minimum HUD agency mortgage guidelines, HUD will not insure the FHA loan.

Each loan the lender originates and funds must meet FHA mortgage lending guidelines. If borrowers do have to meet the minimum HUD Guidelines, the loan will not be insured by HUD. All FHA lenders need to meet minimum agency HUD Guidelines. However, they can also impose and implement higher standards for their mortgage borrowers that surpass the minimum HUD Mortgage Lending Guidelines. The additional guidelines on top of agency guidelines are called mortgage overlays.

Common Mortgage Overlays From Lenders

Most lenders do have overlays from anything from the following:

- credit scores

- to debt to income ratios

- waiting period requirements after a Chapter 13 Bankruptcy discharge date

- verification of rent

- credit tradelines

- collection accounts and charge-off accounts

Agency Versus Mortgage Overlays Imposed By Lenders

Just because HUD says it is okay does not mean that a Lender will accept that. All lenders can have different types of overlays. There are lenders like myself that do not have any mortgage overlays. We will go off the approve/eligible per DU Findings.

Borrowers can have outstanding collections, charge-offs, late payments, repossessions, and bad credit and get an approve/eligible per automated underwriting system as long as the borrower has timely payments in the past 12 months.

We are set to go as long as the borrower meets the minimum lending guidelines. As long as borrowers get an automated approval via the Automated Underwriting System and can meet the conditions on the automated approval, the file should close with lenders with no overlays.

Mortgage Overlays on Collection Accounts and Charge-Offs

HUD does not require that borrowers pay off outstanding collection accounts or charge-off accounts. However, many lenders have overlays on collection accounts and charge-off accounts. They require that all collection and charge-off accounts be paid off even though FHA does not require it. Same with Conventional loans.

All owner-occupant primary home loan programs do not require outstanding collections and charge-off accounts to be paid off. This holds true for FHA, VA, USDA, and Conventional loans. However, FHA loans has the most lenient guidelines when it comes to getting an approve/eligible per automated underwriting system than any other mortgage loan program.

As long as you are purchasing a single-family owner occupying the property, you do not have to pay off any outstanding collection accounts or charge-offs, no matter what the balance is. Unfortunately, most lenders do want collection accounts and charge-off accounts paid off regardless of the lending program’s guidelines. They are adamant about their mortgage overlays on collection accounts.

Mortgage Overlays on FHA Loan After Chapter 13 Bankruptcy

HUD Guidelines On Mortgage After Chapter 13 Bankruptcy state there is no waiting period to qualify for an FHA loan after the Chapter 13 Bankruptcy discharged date. However, most lenders have a mandatory waiting period of one or two years after a Chapter 13 Bankruptcy discharge date.

Gustan Cho Associates are mortgage brokers licensed in 48 states including Puerto Rico and Washington, DC. The team at Gustan Cho Associates are experts in helping borrowers in an active Chapter 13 Bankruptcy repayment plan get approved for FHA and VA loans with a manual underwrite.

This is a lender overlay and not a requirement. Same with Conventional mortgage lenders. Fannie Mae requires a two-year mandatory waiting period after a Chapter 13 Bankruptcy discharge date to qualify for a Conventional loan. However, many lenders will require four years for a borrower to qualify for a conventional loan after a Chapter 13 Bankruptcy discharge date.

Mortgage Overlays on Debt-To-Income Ratio Overlays

HUD will allow up to a 56.9% debt-to-income ratio for borrowers with a 620 FICO or higher credit score. However, most lenders have a debt-to-income ratio that overlays on FHA loans.

High debt-to-income ratio is considered higher risk borrowers. Borrowers with low credit scores may not be able to get a 46.9% front-end and 56.9% back-end debt-to-income ratio cap to get an approve/eligible per automated underwriting system.

There are mortgage lenders that will cap the debt-to-income ratio cap to 43% for borrowers who have credit scores of under 640. Other lenders will cap the debt-to-income ratios to 45% for borrowers with 680 FICO or under credit scores. Then only limit the debt-to-income ratios to 50% DTI for borrowers with over 680 FICO credit scores.

If you have a higher debt-to-income ratio and are looking for a lender with no overlays on debt-to-income ratios, don’t hesitate to contact us at Gustan Cho Associates at 800-900-8569 or text for a faster response. Or email us at gcho@gustancho.com. We are available seven days a week, evenings, weekends, and holidays to answer your calls and questions.

Credit Score Mortgage Overlays

In conclusion, in this article on mortgage overlays, we will emphasize that not all lenders have the same guidelines for the same loan program. Many lenders have credit scores lender overlays for Borrowers. HUD only requires a home buyer to qualify for a 3.5% down payment home purchase FHA loan. Homebuyers just need a 580 FICO credit score. However, almost all banks will require a 640 credit score or higher. Most lenders will not take any borrowers with credit scores of under 620. These are called overlays on credit scores.

Most lenders have overlays on FHA, VA, USDA, and conventional loans. It is important for borrowers with bad credit to understand the basic agency mortgage guidelines so if they are told they do not qualify, they know they do not qualify because of the lender and not because they do not meet guidelines.

As long as borrowers have a 580 FICO credit score, they can qualify for an FHA loan. If you go to a mortgage lender or bank and are told that you do not qualify for an FHA loan because of lower credit scores, please do not hesitate to contact us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.