How To Get Pre-Approved For a Mortgage and Close on Time

This blog will cover how to get pre-approved for a mortgage and close on time. For homebuyers, whether first-time home buyers or seasoned buyers, or homeowners thinking of refinancing, the first and most important step is to see whether or not they qualify for a mortgage.

Factors how to get pre-approved for a mortgage and close on time involve much more than that. If loan originator does not qualify borrowers the right way initially, they will go through a stressful mortgage approval process. May get denied at the end or go through stumble blocks during the mortgage process. If the loan officer did not package the file correctly, providing mortgage conditions requested by mortgage underwriters can be very stressful. The reason why mortgage loans get denied at the very end is the fact borrowers were not qualified the right way.

How to get pre-approved is to meet the minimum lending guidelines. The most important factor in how to get pre-approved for a mortgage and close on time is for borrowers to be fully qualified.

How To Get Pre-Approved For a Mortgage With Bad Credit

You do not need perfect credit, a large down payment, and no outstanding collections and charge-off accounts to qualify for a mortgage. Homebuyers can qualify for a mortgage with credit scores down to 500 FICO, outstanding collections and charge-off accounts, high debt-to-income ratio, bad credit, and derogatory credit tradelines older than 12 months old. The key to getting an approve/eligible per automated underwriting system is to have been timely on all payments in the past 12 months.

The mortgage qualification process is not as simple as a loan originator just taking a 1003 mortgage loan application and running credit. The loan officer issues a pre-approval letter if income and credit scores are in line.

Just because the borrower does not qualify currently does not mean they cannot get a mortgage loan approved and closed. For borrowers who do not meet mortgage qualification requirements, the loan originator needs to correct the issues where they can meet the minimum guidelines or find an alternative financing loan program.

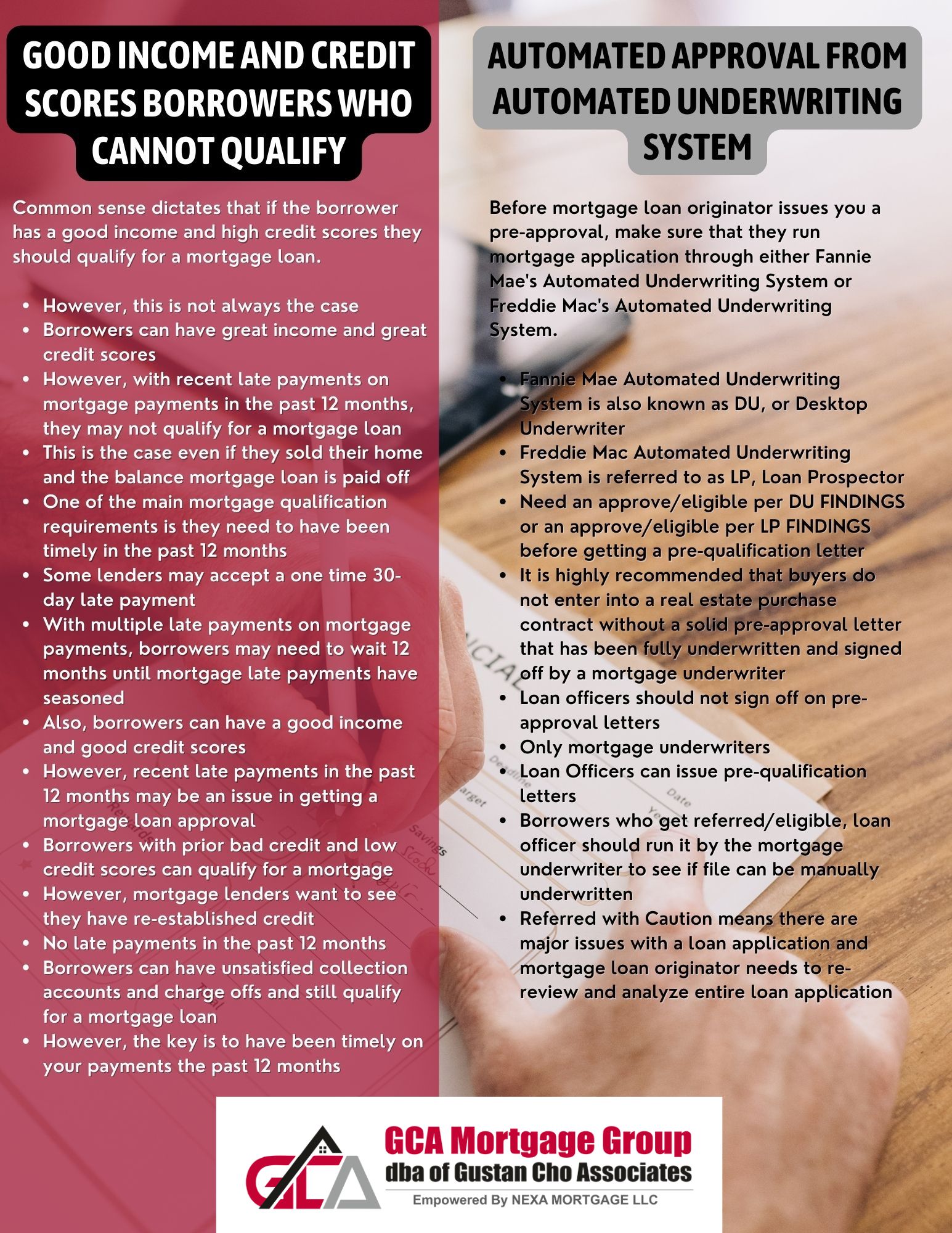

How To Get Pre-Approved For a Mortgage With Good Income But Low Credit Scores

A frequently asked question is how to get pre-approved for a mortgage with good income but low credit scores. Common sense dictates that if the borrower has a good income and high credit scores, they should qualify for a mortgage loan. However, this is not always the case. Borrowers can have great income and great credit scores. However, with recent late payments on mortgage payments in the past 12 months, they may not qualify for a mortgage loan. This is the case even if they sell their home and the balance mortgage loan is paid off.

One of the main mortgage qualification requirements is they need to have been timely in the past 12 months. Some lenders may accept a one-time 30-day late payment. With multiple late payments on mortgage payments, borrowers may need to wait 12 months until late mortgage payments have seasoned. Also, borrowers can have a good income and good credit scores.

Recent late payments in the past 12 months may be an issue in getting a mortgage loan approval. Borrowers with prior bad credit and low credit scores can qualify for a mortgage. However, mortgage lenders want to see they have re-established credit. No late payments in the past 12 months. Borrowers can have unsatisfied collection accounts and charge-offs and still qualify for a mortgage loan. However, the key is to have been timely on your payments for the past 12 months.

How To Get Pre-Approved From The Automated Approval from Automated Underwriting System

Before the mortgage loan originator issues you a pre-approval, ensure that they run the mortgage applications through either Fannie Mae’s Automated Underwriting System or Freddie Mac’s Automated Underwriting System.

Fannie Mae Automated Underwriting System is also known as DU or Desktop Underwriter. Freddie Mac Automated Underwriting System is referred to as LP, Loan Prospector. Need an approve/eligible per DU FINDINGS or an approve/eligible per LP FINDINGS before getting a pre-qualification letter. It is highly recommended that buyers do not enter into a real estate purchase contract without a solid pre-approval letter that has been fully underwritten and signed off by a mortgage underwriter.

Loan officers should not sign off on pre-approval letters. Only mortgage underwriters. Loan officers can issue pre-qualification letters. For borrowers who get referred/eligible, the loan officer should run it by the mortgage underwriter to see if the file can be manually underwritten. Referred with Caution means there are major issues with a loan application and the mortgage loan originator needs to re-review and analyze the entire loan application.

Automated Approval From AUS Versus Overlays

Just because borrowers get an approve/eligible per DU FINDINGS, or LP FINDINGS does not mean they are solid and set to go. It depends on the mortgage lender. There are lenders like myself who have zero lender overlays on government and conventional loans. We go off DU FINDINGS or LP FINDINGS. This is because we have no mortgage lender overlay.

A mortgage lender overlay is additional guidelines above and beyond the automated findings that a particular lender implements. For example, if debt-to-income ratios are at 56.9% and we get the approve/eligible per DU FINDINGS, we have no issues.

Suppose a lender has overlays on debt-to-income ratios that cap debt-to-income ratios at 45% or 50% and debt-to-income ratios at 56.9%. In that case, that lender cannot do the loan because the borrower will not qualify with that particular lender. The borrower will qualify with me because I go off the findings of the automated approval.

How To Get Pre-Approved With Unpaid Collection Accounts

Borrowers can get pre-approved without paying outstanding collection accounts. Unpaid collection accounts do not have to be paid off to qualify for a home loan.

With automated approval with unsatisfied collection accounts, borrowers should be set to go if they choose a lender with no overlays, like us at Gustan Cho Associates.

Many lenders have overlays requiring borrowers to pay off unsatisfied collection accounts to meet their lending standards. With an approve/eligible per DU FINDINGS or LP FINDINGS with unsatisfied collection accounts, borrowers need to check with the mortgage loan originator whether or not his mortgage company has overlays on collection accounts.

Mortgage loan originators are human and make mistakes like many of us. Many times, a mortgage loan originator may submit a mortgage application to processing and underwriting without checking on their overlays or not properly qualifying the borrower.

Gustan Cho Associates, empowered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states including Washington, DC, Puerto Rico, and the United States Virgin Islands. The team at Gustan Cho Associates has a national reputation of being able to do mortgage loans other lenders cannot do.

This will backfire, and the mortgage loan may get denied. Mortgage Qualification is very basic. But yet, the most important factor in getting a mortgage approved and closed on time. Anyone with any questions about the content of this blog or need to get qualified for a mortgage, please contact us at Gustan Cho Associates at 262-716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.