FHA Loans With Charge-Offs Mortgage Guidelines

This blog will cover HUD charge-off account guidelines on FHA loans. I get this question asked several times a day: Why do I have to pay a charge-off to qualify for an FHA loan?

Many home buyers who call me every day are told that they are told to pay off all of their charged-off collection accounts by banks and other lenders they go to for them to qualify for FHA loans. This is not true.

Many mortgage loan originators are either incompetent or do not know the HUD 4000.1 FHA Handbook Borrowers do not have to pay off any outstanding unpaid collection accounts and charge-off accounts to qualify for FHA loans. HUD exempts medical collections and charge-off accounts from debt-to-income ratio calculations. In this article, we will discuss and cover the HUD charge-off account guidelines on FHA loans.

HUD Charge-Off Accounts Guidelines on Medical Versus Non-Medical Collections

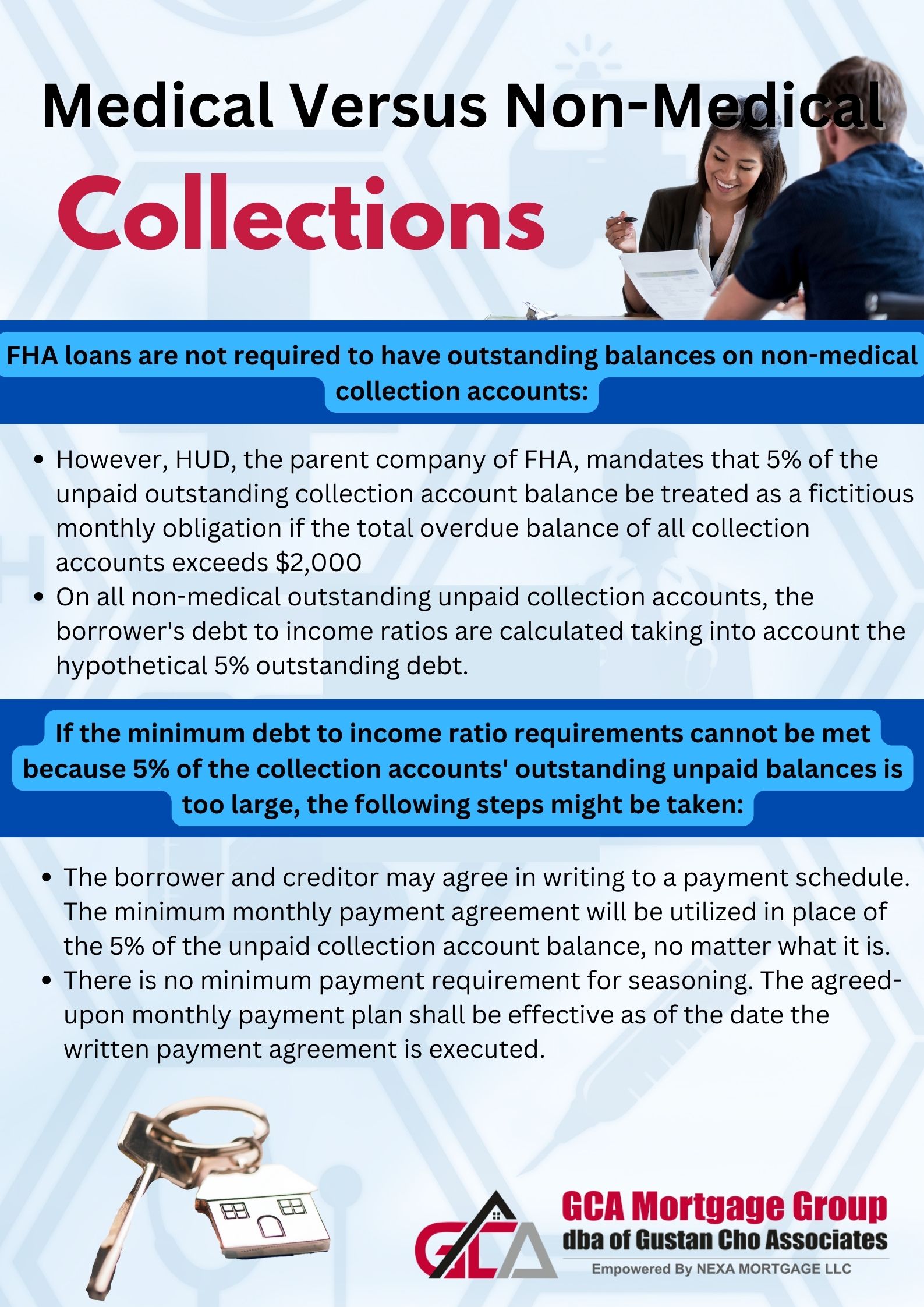

Non-medical collection accounts with outstanding balances do not have to be paid to qualify for FHA loans: However, if the outstanding collection account balances of all collection accounts are greater than $2,000, then HUD, the parent of FHA, requires that 5% of the unpaid outstanding collection account balance as a hypothetical monthly debt. The borrower’s debt-to-income ratios calculations consider the 5% outstanding hypothetical debt on all non-medical outstanding unpaid collection accounts.

Suppose 5% of the unpaid outstanding balances of the collection accounts is too high and will disqualify meeting the minimum debt-to-income ratio limits. In that case, the following can be done: The borrower can enter into a written payment agreement with the creditor. Whatever the minimum monthly payment agreement is, that monthly agreement will be used in place of the 5% of the outstanding unpaid collection account balance

There is no minimum payment seasoning required. On the date the written payment agreement is executed, the monthly payment agreement that is agreed upon will go into effect. There is no 3-month seasoning required, like it is for judgments and IRS income tax written payment agreements.

Why Lenders Require Charge-Off Be Paid Off When HUD Charge-Off Account Guidelines Do Not Require It

Why do I have to pay a charge-off to qualify for an FHA loan? This is what banks and mortgage lenders tell many borrowers. This is not an FHA Requirement but may be a mortgage lender overlay. What are mortgage lender overlays? Mortgage lender overlays are additional requirements imposed for borrowers by each lender that surpass HUD’s FHA minimum lending guidelines.

Per HUD charge-off account guidelines, HUD does not require borrowers to pay off outstanding unpaid collection accounts and charge-off accounts. But a mortgage lender may require it.

Those borrowers who are told that they do not qualify for an FHA loan due to having outstanding collection accounts and charge-off accounts DO NOT have to if they find a lender with no overlays on FHA loans. The only way that they will qualify for an FHA loan is by paying off the charge-off accounts and outstanding collection accounts. They need to find a different mortgage lender like myself where we do not have overlays on HUD charge-off account guidelines and outstanding collection accounts.

Do HUD Charge-Off Account Guidelines Mandate Charge-Offs Be Paid?

Homebuyers can qualify for an FHA loan with a second mortgage charge-off account without paying off the second mortgage charge-off account balance. Unfortunately, many loan officers tell borrowers that they must pay off the second mortgage charge-off account. This is the worst mistake Borrowers can ever make because if you pay off the second mortgage charge off the account, that resets the statute of limitations.

The three-year mandatory waiting period to qualify for an FHA loan after a second mortgage charge-off. Under HUD Guidelines on qualifying for an FHA loan after a second mortgage charge off there is no waiting period. Most lenders have overlays of three years from the date of the second mortgage charge-off that is reflected on the borrower’s credit report or the date of the second mortgage charge-off settlement date, whichever is later. Paying off the second mortgage charge off the account will restart the three-year waiting period to qualify for an FHA loan.

If a mortgage lender tells you that you do not qualify for an FHA loan because there is an outstanding balance on your credit report due to the second mortgage charge off the account, they do not know how to read credit reports. I need to explain to the mortgage loan originator that in most charge-off accounts, whether regular consumer charge-off accounts or first or second mortgage charge-off accounts, there is always an outstanding unpaid collection account balance reporting on all charge-off accounts. Unfortunately, many mortgage loan officers still do not know this and are screwing up by telling borrowers to pay off the charge-off accounts where they do not need to.