UPDATE on FHA Mortgage Insurance Premium on FHA Loans

HUD, the Federal Housing Administration parent, has lowered the hefty FHA mortgage insurance premium on FHA loans by 30 basis points. The annual FHA mortgage insurance premium of 0.85% got reduced to 55% of the mortgage loan balance. Reducing FHA mortgage insurance premium is a welcome move for many Americans. This holds especially true for those who experienced a severe pinch from the high mortgage rates and prices experienced in the previous year. Dale Elenteny of Gustan Cho Associates issued the following statement:

Statistics state that nearly 84% of all FHA mortgage borrowers are first-time homebuyers, while about 43% have low incomes. This reduction will undoubtedly be good news to many people, not to mention that the reduction might attract new borrowers who couldn’t apply for a loan due to the high mortgage insurance premiums.

FHA loans are attractive to many borrowers due to the low down payment and more lax credit requirements. Some families do shy away due to mortgage insurance. So what is mortgage insurance? In the following paragraphs, we will cover the FHA mortgage insurance guidelines on FHA home loans. In the following paragraphs in this guide, we will cover the reduction of FHA mortgage insurance premium on FHA loans.

How Reduction on FHA Mortgage Insurance Premium Gives Homebuyers More Buying Power

Anyway, suppose you are a borrower looking to refinance an existing loan or a prospective homebuyer looking to apply for an FHA loan. In that case, these changes are good news for you. Even better, it doesn’t matter what kind of home you want to buy, as the reduction applies to loans aimed at purchasing single-family homes, manufactured homes, and condominiums.

If you had already successfully applied for an FHA loan before the changes were implemented, you would have to refinance the loan to benefit from the said reduction. Bottom line As we conclude, the recent reduction of FHA mortgage insurance premiums by the HUD is undoubtedly a welcome move for many FHA borrowers across the United States.

This blog will cover the FHA mortgage insurance guidelines on FHA home loans. FHA mortgage insurance guidelines can be hard to understand. And as referenced in the 4000.1 HUD handbook, the rules recently changed on mortgage insurance premiums.

What Is Mortgage Insurance Per FHA Mortgage Insurance Guidelines

Mortgage insurance is an insurance policy that protects the lender or investor in case of default. The mortgage insurance will pay the lender the remaining balance if and when an insured loan defaults. Homebuyers may be asking, what does mortgage insurance do for you?

It is not every other time that the government tries to make homeownership accessible to more families by reducing the cost of mortgages. However, this time, low-income borrowers and first-time homebuyers, who had previously found it very challenging to access mortgages due to lack of larger down payments, have a reason to smile.

The answer is quite simple, nothing. It is an instrument that protects the lender and usually allows borrowers to enter into a loan they may not have qualified for without the extra insurance. Since this article focuses on FHA mortgage insurance, we will go into more detail now.

Types of Mortgage Insurance

FHA Mortgage Insurance Guidelines require two types of mortgage insurance:

- upfront mortgage insurance premiums

- monthly mortgage insurance premiums

FHA loans do have both mortgage insurances associated with them. Unlike conventional financing, FHA mortgage insurance premiums do not change based on credit score. They change slightly depending on the down payment and term of the FHA Loan. So how are they calculated?

How Is Mortgage Insurance Calculated

Before explaining the true cost of mortgage insurance, it is important to understand the term basis point.

- One basis point is equal to 1/100 of a percent or .0001 in decimal form

- Basis points usually describe changes in bond yields or interest rates

- As you can tell, this term is used in the finance industry quite frequently

Let’s give a few examples before we move on.

- 100 basis points are equal to 1%

- 125 basis points are equal to 1.25%

- 1000 basis points are equal to 10%

Upfront FHA Mortgage Insurance Premium

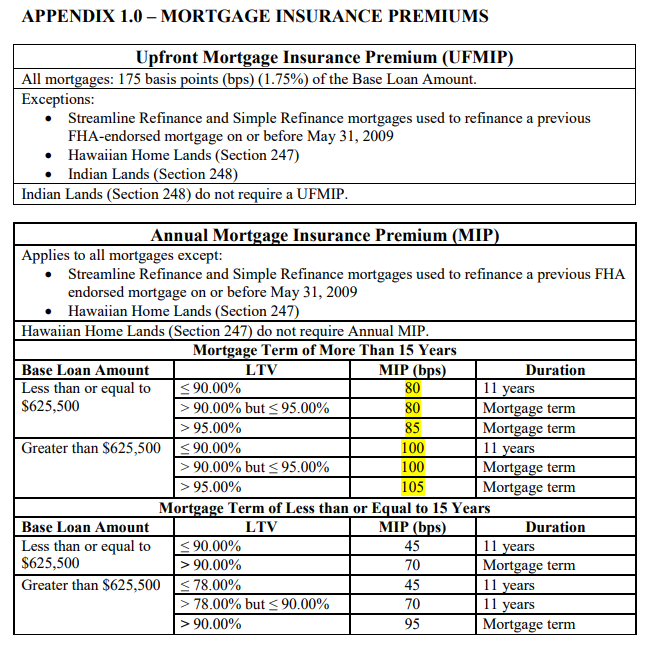

The upfront mortgage insurance premium, commonly abbreviated as UFMIP, is always calculated off the loan amount. All FHA mortgages in 2018 have 175 basis points or 1.75% of the base loan amount as an upfront mortgage insurance premium. The only exception to this rule is for homes located on Indian lands. Please see section 248 of the HUD 4000.1 FHA Handbook for more information. What does this mean for me and obtaining my FHA loan? The answer is not much.

Even though the reduction may not solve the problem of the high cost of homeownership entirely, it is a positive step forward. If you plan to, this is a better time to apply for an FHA- insured mortgage. Consult your mortgage broker or financial adviser today about the HUD announcement and how it will affect you.

This upfront mortgage insurance premium can be paid out of pocket. But most borrowers roll this mortgage insurance premium into their total loan amount. That is allowed per FHA Guidelines. Choosing to finance this premium into your loan will result in a slightly higher monthly payment and a higher overall cost of your loan. Please remember that this is the most common way borrowers enter into an FHA loan.

Case Scenario on FHA MIP

Let’s give an example;

- Say you want to buy a home for $200,000 with a 30-year FIXEE-rate FHA loan

- You will put down the 3.5% required down payment.

- You have selected to roll the upfront mortgage insurance premium into your loan

$200,000 (base loan amount) * 175 basis points (UFMIP) = $203,500 (total loan amount)

- In this example, you will pay 85 basis points as your annual mortgage insurance premium

- As you put down less than 5% and choose a 30-year term

The reference above chart.

FHA Mortgage Insurance Premium

As stated above, FHA mortgages also include a monthly mortgage insurance premium. Unlike private mortgage insurance, the FHA annual mortgage insurance is paid directly to the Federal housing in ministration monthly. This provides funding for the FHA. Monthly FHA mortgage insurance used to cancel itself out similarly to PMI.

Unfortunately, this has now changed. On the bright side, the monthly cost associated with mortgage insurance has gone down from 105 basis points to 85 basis points when putting down less than 5% for loan amounts below $625,000. In today’s rising rate environment, FHA mortgage insurance premium are typically lower than PMI for lower credit score borrowers. Making the FHA loan a very attractive option.

FHA Mortgage Insurance Premium Guidelines on FHA Versus Conforming Loans

Do you have to pay mortgage insurance? The answer is no, as long as borrowers qualify for a conventional mortgage and have at least a 20% down payment. Angie Torres, the National Operations Director at Gustan Cho Associates, said the following about FHA mortgage insurance premium:

If borrowers do not have 20% down, they can always use an FHA loan to buy a home and refinance into a conventional loan to eliminate mortgage insurance premium. This is one of the most popular reasons to refinance.

Please contact the expert at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We will be able to answer any questions regarding FHA mortgage insurance premium.

How Much Do I Have To Put Down To Avoid Mortgage Insurance on FHA Loans?

Michael Gracz is the author of this blog, FHA Mortgage Insurance Guidelines. Mike Gracz is a senior writer/contributing editor for Gustan Cho Associates. The National Sales Manager and Senior Loan Officer at Gustan Cho Associates. Michael is a veteran mortgage professional and expert in government and conventional loans.

We can also assist with conventional, VA, Jumbo, and NON-QM loans. If you are located in a state we are not licensed is not licensed, another associate of Gustan Cho Associates can help. With years of expertise, there are a few situations that we have not come across. Feel free to reach out to receive a personal one-on-one consultation.

Mike Gracz has helped countless home buyers nationwide who could not qualify at other lenders. Michael Gracz’s business model at Gustan Cho Associates does not have any FHA, VA, USDA, and Conventional loans overlay. He is also an expert on non-QM loans and bank statement loans for self-employed borrowers. Michael is available evenings, weekends, and holidays seven days a week. Please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

This blog on FHA mortgage insurance guidelines was updated on February 27th, 2023.