Non-Conforming Mortgage Loans

This article will cover non-conforming mortgage loans and bank statement mortgages for self-employed borrowers. There are no income tax returns required on bank statement mortgages. Dale Elenteny of Gustan Cho Associates explains non-conforming mortgage loans:

Any mortgage loans do not conform to Fannie Mae and Freddie Mac mortgage lending guidelines are called non-conforming loans.

Jumbo Loans, bridge loans, hard money loans, commercial loans, and condo hotel loans are examples of non-conforming mortgage loans. Non-Conforming Mortgage Loans are often called portfolio mortgage loans. This is because lenders who originate and fund non-conforming loans often keep the mortgage loans they originate and fund in their books and do not sell the loans to the secondary market. In the following paragraphs, we will cover non-conforming mortgage loans and various non-conforming mortgages.

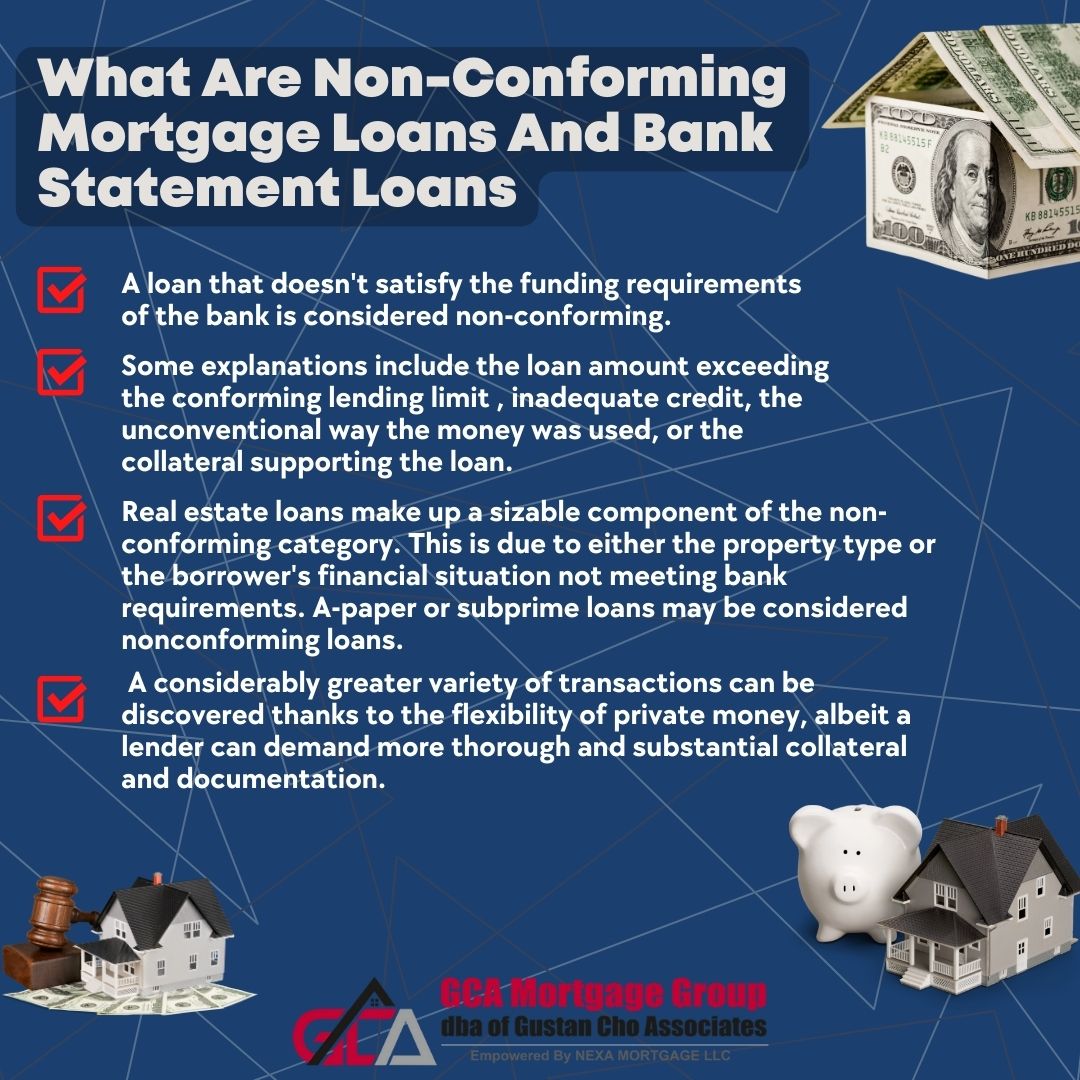

What Are Non-Conforming Mortgage Loans And Bank Statement Loans

A non-conforming loan is a loan that fails to meet bank criteria for funding.

Reasons include the loan amount being higher than the conforming loan limit (for mortgage loans), lack of sufficient credit, the unorthodox use of funds, or the collateral backing it. In many cases, non-conforming loans can be funded by hard money lenders or private institutions or private individuals via private money.

Hard money loans or private money loans are loans made by private individuals or groups under their own terms and conditions. Interest rates on hard money and private money loans are high and so are the down payment requirements.

A large portion of real-estate loans is qualified as non-conforming. This is because the borrower’s financial status or the property type does not meet bank guidelines. Nonconforming loans can be either A-paper or subprime loans. The flexibility of private money can allow for a much wider range of deals. However, a lender may require more detailed and substantive collateral and documentation.

Selecting a Non-Conforming Lender

Borrowers should select non-conforming lenders as carefully as they would shop for any other loan. Look for good rates and especially a good customer service rating. Rates for non-conforming lenders are typically higher than those banks, but terms are more flexible, and loans are more easily attainable. Many companies advertising non-conforming loans are brokers who refer the loan requests they field to lenders.

Types of Mortgage Loan Options

Commercial non-conforming loans are also known as hard money loans and comprise many non-conforming loans. They are used to fund industrial and retail projects like RV parks, theatre complexes, gas stations, medical centers, and more.

Many commercial, non-conforming loans are high-interest, short-term bridge loans.

Residential non-conforming loans are strictly regulated, usually with much higher rates than banks. Some states have legal limits against nonconforming loans for residential real estate.

Bank Statement Loans For Self-Employed Borrowers

Gustan Cho Associates now offers bank statement loans for self-employed borrowers. Gustan Cho Associates has 12 months of bank statement mortgage loans for self-employed borrowers.

Income tax returns and income documentation are not required on bank-statement mortgage loans for self-employed borrowers. The borrower’s monthly deposits are averaged over the past 12 months. The average monthly deposits for the past 12 months is used as the qualified income. Withdrawals does not matter. If the borrower deposits $10,000 every month for the past 12 months and withdrawals $9,999.99 the next day after the deposit, we would still use the $10,000 per month deposit and disregard the withdrawal.

We also have NON-QM Loans for home buyers with no waiting period after bankruptcy and foreclosure. A 20% down payment is required. There are no maximum loan limits with Non-QM Loans. Private mortgage insurance is not required on Non-QM Loans. To qualify for nonconforming and alternative financing mortgages, don’t hesitate to get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.