Buying a Home in North Carolina With Poor Credit

In this blog, we will cover buying a home in North Carolina with bad credit. Buying a home is a significant milestone in life, and it’s one that many people aspire to achieve. However, when you have poor credit, it can feel like an uphill battle. The good news is that buying a home in North Carolina with poor credit is still possible with the right strategies and knowledge.

The housing market in North Carolina is booming. More importantly, home buyers in North Carolina need to realize that you do not need a 20% down payment and perfect credit to buy a home in North Carolina. In this comprehensive blog we will explore the steps you can take, frequently asked questions, and brief answers to help you navigate the home-buying process with less-than-perfect credit.

Interested in buying a home in North Carolina with Poor Credit? Click Here.

Why So Many People Are Moving To North Carolina?

It is no secret why so many people are moving to North Carolina. It is not just individuals, families, and job seekers, but thousands of businesses are moving to North Carolina.

Many people are moving and flocking to North Carolina, in search of bettering their family’s lives. With its coastline, Lake Norman, the Blue Ridge Mountains, and mild winters, it’s no wonder people are heading there! There are approximately 11 million people living in North Carolina, and about 62% of these people own homes.

What Is The Average Cost of a Home In North Carolina?

One of the most frequently asked questions asked at Gustan Cho Associates is what is the median purchase price of a home in North Carolina.

Although North Carolina is so popular, the cost of living there is actually 95 as compared to the national index of 100. The median purchase price in North Carolina is around $250,000, which is a tad lower than the national average, and home appreciation in this state is increasing! However, if you choose to live in a larger city, such as Charlotte or Raleigh, the median home price is $425,000. This is on par with the rest of the country for big city living due to prime area demand.

Buying a Home in North Carolina With Bad Credit

Many renters often ask can I get a loan in North Carolina if I have bad credit?

What if you want a life change and are either tired of renting or wanting to move to North Carolina, but your credit is not in the right place? You might be wondering if you can still qualify for a loan. The answer is yes. There are other ways to qualify for a home loan, even if your credit is considered low.

Buying a Home in North Carolina As a First-Time Home Buyer

What Will Lenders Look for When Applying for a Home Loan? When applying for a home loan, the lender will look at your credit score, work history, ability to make your down payment, and your debt-to-income ratio. If you are lacking in one area, you can make up for it in another area. For example, if your credit score is 500, but you have money available for your down payment, solid work history, and low debt-to-income ratio, you can still qualify!

How Mortgage Underwriters Look at Your Financial and Work Stability

A lender will check your employment history and can check anywhere from 6 months to 2 years of history. In order to show your employment history, you will need to supply paystubs and W2s.

Buying a House in North Carolina With a Low Credit Score

FICO is the most used credit score and is generated for lenders to use to determine if you can be approved for a loan. When a lender looks at your credit score, they are checking to see where in the range from 300-850 you fall. The lower the number, the less favorable your score is. Normally, lenders will want to see a credit score of 670 or higher, but you can get a loan with a FICO score of 500.

Buying a House in North Carolina With a High Debt-To-Income Ratio

When you apply for a mortgage, and especially important if you have a lower credit score, lenders will want to see a low debt-to-income ratio. This is determined by taking the amount of debt you have and comparing it to your income. Each month, you pay bills. This includes credit card payments, car payments, and student loans. Lenders typically want to see that you will be able to make your payments.

What Are The Down Payment and Closing Costs Buying a Home in North Carolina

Down Payment and Closing Costs are required buying a home in North Carolina. Do you have enough money saved to pay for your down payment and closing costs? The amount of the down payment you will need varies, starting at 3% but vastly depends on loan type and the amount you borrow. If you have lower credit, you will need a larger down payment, and lenders like to see about 20% down. If you do not put at least 20% down, you will need to have private mortgage insurance.

Shopping For the Types of Mortgages That is Best For Me

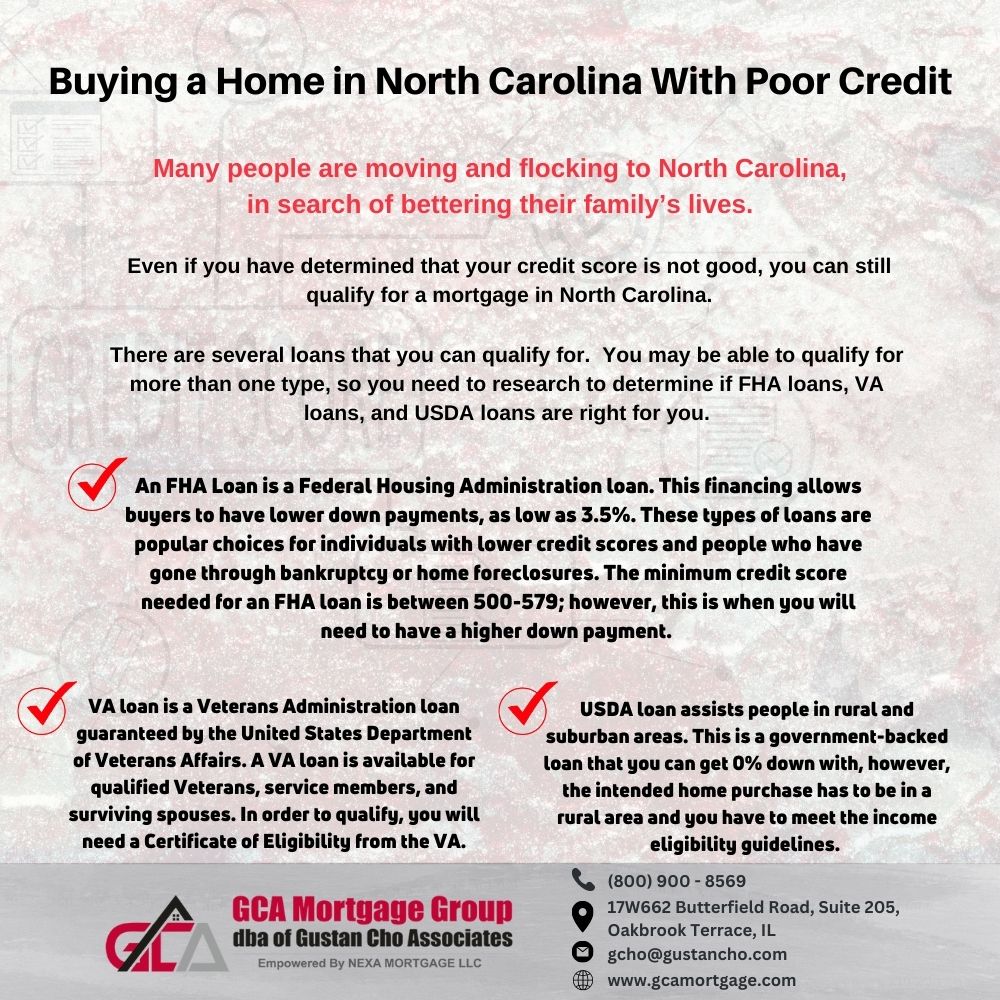

A frequently asked question by many buying a home in North Carolina is what types of Loans are available in North Carolina for Low Credit Borrowers? Even if you have determined that your credit score is not good, you can still qualify for a mortgage in North Carolina.

There are several loans that you can qualify for. You may be able to qualify for more than one type, so you need to research to determine if FHA loans, VA loans, and USDA loans are right for you. Normally, individuals with a lower credit score might have trouble qualifying for a conventional loan. This is where FHA loans, VA loans, and USDA loans come in.

Buying a Home in North Carolina With USDA Loans

A USDA loan assists people in rural and suburban areas. This is a government-backed loan that you can get 0% down with, however, the intended home purchase has to be in a rural area and you have to meet the income eligibility guidelines. Buy a home in North Carolina with USDA, VA, FHA loans, Click Here.

Buying a Home in North Carolina With an FHA Loan

An FHA Loan is a Federal Housing Administration loan. This financing allows buyers to have lower down payments, as low as 3.5%. An FHA loan is insured by the Federal Housing Administration and is considered low risk as the government has insured them. These types of loans are popular choices for individuals with lower credit scores and people who have gone through bankruptcy or home foreclosures. The minimum credit score needed for an FHA loan is between 500-579; however, this is when you will need to have a higher down payment.

Buying a Home in North Carolina With a VA Loan

A VA loan is a Veterans Administration loan guaranteed by the United States Department of Veterans Affairs. A VA loan is available for qualified Veterans, service members, and surviving spouses. These loans are still made by private lenders (banks and mortgage companies). In order to qualify, you will need a Certificate of Eligibility from the VA. The VA does not have a minimum credit score or debt-to-income ratio requirement; however, the lender will set this.

How Much Is Homeowners Insurance in North Carolina?

Living in North Carolina may mean that you will want to check into home flood and wind damage insurance and coverage. This will depend on where in North Carolina you want to buy, as it will be more expensive by the coast. Even though you have bad credit, it will not necessarily disqualify you from owning a home.

Frequently Asked Questions

Now, let’s address some frequently asked questions and provide brief answers to help you understand how to buy a home in North Carolina with poor credit.

- Can I get a mortgage in North Carolina with a credit score below 600? While getting a mortgage with a credit score below 600 is possible, it can be challenging. Consider government-backed loan programs like FHA loans, which may consider credit score as low as 500 if a more substantial down payment is provided.

- Are there specific credit score requirements for different types of loans in North Carolina? Yes, different types of loans may have varying credit score requirements. As an illustration, conventional loans typically demand a superior credit score compared to FHA or VA loans.

- How long does it take to improve my credit score significantly? The time it takes to improve your credit score can vary depending on your starting point and the steps you take. It could take several months to a year or more to see significant improvement.

- Can I get a mortgage if I’ve had a recent bankruptcy or foreclosure? While recent bankruptcies or foreclosures can make it more challenging to secure a mortgage, it’s not impossible. Some government programs have waiting periods after these events, so explore your options.

- How does my employment history factor in when seeking a mortgage with less-than-favorable credit? Lenders may consider your employment stability when evaluating your mortgage application. A consistent employment history can work in your favor.

- Can I use a co-signer to qualify for a mortgage with poor credit? Having a co-signer with good credit can increase your chances of qualifying for a mortgage. However, the co-signer is also responsible for the loan, and their credit is at risk if you default.

- Are there specific North Carolina programs for homebuyers with poor credit? North Carolina offers various housing programs and down payment assistance programs. Some of these may be accessible to individuals with lower credit scores.

- What should I do if my mortgage application is denied due to poor credit? If your application is denied, improve your credit, consider alternative financing options, and seek advice from a credit counselor or a mortgage professional.

- Can I negotiate with lenders to lower interest rates with poor credit? While negotiating interest rates is possible to some extent, lenders typically base rates on creditworthiness and market conditions. Focus on improving your credit to secure better rates.

- Should I consider rent-to-own or lease-to-own options if I have poor credit? Rent-to-own or lease-to-own arrangements can be options for those with poor credit, but they require careful consideration. Ensure you understand the terms and potential risks involved.

Best Mortgage Lenders For Bad Credit in North Carolina With No Overlays

If you are thinking about buying a home in North Carolina, check your credit score and finances. You can raise your score and have a solid understanding of what you need to do in order to qualify for a new home. Once you know your score, and your debt-to-income ratio, you can work towards saving for a down payment and improving your finances to put yourself in the best possible place to own.

Loan officers here at Gustan Cho Associates are experts when it comes to buying a home in North Carolina. Call us now at 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. We are available even during weekends and holidays!

Prequalified in just 5 minutes!