VA Collections Mortgage Guidelines on VA Home Loans

In this blog, we will discuss and cover VA collections mortgage guidelines. We will discuss how you can qualify for VA loans without paying outstanding collection accounts. The Department of Veterans Affairs has recently updated the VA collections mortgage guidelines on VA home loans. Gustan Cho Associates specializes in VA mortgages. VA guidelines are constantly changing. Dale Elenteny of Gustan Cho Associates said the following:

We will update you on VA collection guidelines. On May 26, 2019, VA introduced a new guideline surrounding non-medical collections reporting to your credit report.

This article will detail the old rule versus the new one. We will discuss how this affects thousands of veterans nationwide when buying a home. This blog will discuss the recent changes in the VA collections mortgage guidelines on VA home loans.

VA Collections Mortgage Guidelines Versus Lender Overlays

Collection accounts and VA mortgages. Collections are past-due accounts in a collection status on your credit report. Collections do negatively impact your credit score. The more collections you have, the harder it will be for your credit score to recover. The VA does not necessarily require the veteran to pay off collections to enter into a mortgage. However, there must be an amount factored into your debt-to-income ratio.

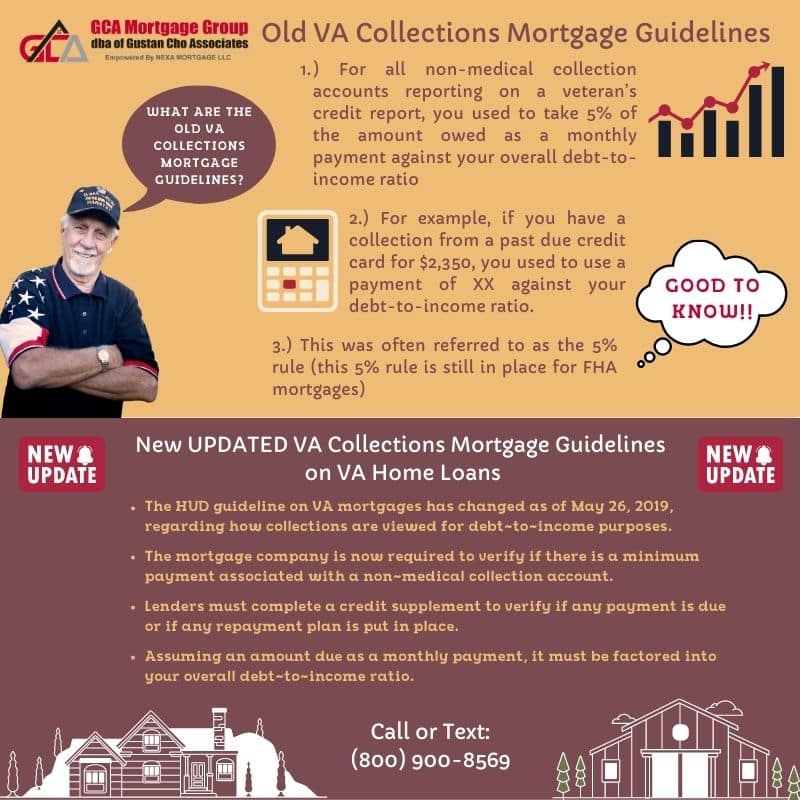

Old VA Collections Mortgage Guidelines

The old rule on VA loans:

- For all non-medical collection accounts reporting on a veteran’s credit report, you used to take 5% of the amount owed as a monthly payment against your overall debt-to-income ratio

- For example, if you have a collection from a past due credit card for $2,350, you used to use a payment of XX against your debt-to-income ratio.

- This was often referred to as the 5% rule (this 5% rule is still in place for FHA mortgages)

New UPDATED VA Collections Mortgage Guidelines on VA Home Loans

The new VA collection guideline:

- As of May 26, 2019, the HUD guideline has changed on VA mortgages regarding how collections are viewed for debt-to-income purposes

- The mortgage company now must verify if there is a minimum payment associated with a non-medical collection account

- The lender must complete a credit supplement to verify if any payment is due or if any repayment plan is put in place

- Assuming an amount due as a monthly payment, it must be factored into your overall debt-to-income ratio.

This can harm your overall mortgage qualifications.

Monthly Payment on Outstanding Collections

A payment associated with the collection account can decrease your purchasing power of buying your home with a VA loan.

This could adversely affect if the minimum payment due exceeds 5% of the collection amount. This will then decrease your purchasing power. This is because you will qualify for a lower overall monthly payment. On the flip side, this can also help some veterans.

Credit Payment History on Credit Report

If the credit supplement supports a $0 payment, the 5% of the amount due will not be turned back into your debt-to-income ratio. Alex Carlucci of Gustan Cho Associates said the following:

A $0 payment will increase your buying power. Being 100% open and honest with your loan officer is now more important than ever.

In the beginning stages, the loan officer will not know that payment is associated with your collection accounts. This can affect you once you are under contract.

Paying Old Collection Accounts With Written Payment Agreement

If any repayment plan is implemented, you must tell your loan officer out front so that amount is factored into your pre-approval. There is no rhyme or reason for how collections report to your credit report. Many collection agencies are small businesses that purchase bad debt and attempt to collect those funds. The small companies report to credit bureaus in funky ways. Sometimes you will see an amount due and payment lining up the same. Borrowers with more than likely will not have a $1000 a month monthly payment, but the credit report can reflect a $1,000 monthly payment. The credit supplement will get the mortgage underwriter clarification on how much is done if any amount is due.

Qualifying For VA Loans With Mortgage Lender With No Overlays

Small changes like this can seriously impact a veteran’s qualifications. Little changes like this happen all the time in the mortgage industry. It is important to find a lender, such as Gustan Cho Associates, who is up-to-date on mortgage guidelines.

The Team at Gustan Cho Associates is available seven days a week, mornings and evenings. We are always here to assist you with mortgage questions.

Gustan Cho Associates is a NO LENDER OVERLAYS lender specializing in lower credit score qualifications. There are very few situations we have not seen before. We look forward to assisting you in buying your dream home!