Things To Avoid During Mortgage Process

In this article, we will cover things to avoid during mortgage process for homebuyers and close on time. We will discuss tips on things to avoid during mortgage process to avoid a last-minute mortgage loan denial. Alex Carlucci of Gustan Cho Associates said the following:

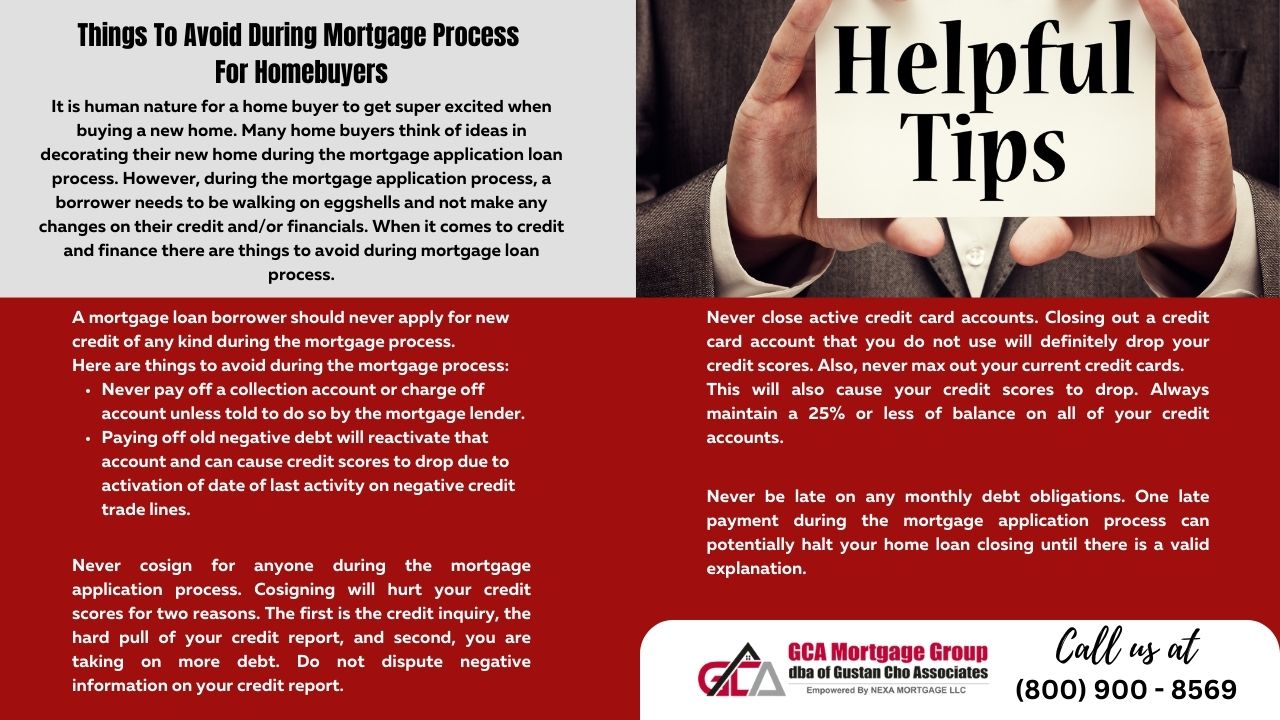

It is human nature for a home buyer to get super excited when buying a new home. Many home buyers think of ideas for decorating their new homes during the mortgage application loan process.

During the mortgage application process, a borrower must walk on eggshells and not make any changes to their credit and financials. When it comes to credit and finance, there are things to avoid during mortgage loan process. In the following paragraphs, we will cover things to avoid during mortgage process so there are no delays with the home closing and to avoid any chance of a last-minute mortgage loan denial

What Things To Avoid During Mortgage Loan Process?

When a mortgage loan borrower completes their 1003 mortgage application, the mortgage loan officer pulls a credit check. The Loan Officer will review two years’ tax returns, W2s, and paycheck stubs. The LO will run the credit report and mortgage application through an Automated Underwriting System. Once the AUS yields approve/eligible, a pre-approval is issued. Dale Elenteny of Gustan Cho Associates, said the following:

If the mortgage borrower meets all the guidelines, the AUS will render an approve/eligible per AUS. Hard credit inquiries will cause a drop in credit scores. Charging large ticket items such as appliances and new furniture will affect debt-to-income ratios.

Large purchases on a credit card will increase the credit debt and the DTI. Credit card balances over a 20% credit utilization ratio will cause a drop in credit scores. More monthly payments will increase debt to income ratio, potentially disqualifying borrowers for a home loan.

Avoid New Credit Top Thing To Avoid During Mortgage Process

A mortgage loan borrower should never apply for new credit during the mortgage process. Here are things to avoid during the mortgage process:

- Never pay off a collection account or charge off the account unless told by the mortgage lender.

- Paying off old negative debt will reactivate that account and can cause credit scores to drop due to activation of the date of last activity on negative credit trade lines.

Don’t Close Credit Accounts Are Things To Avoid During Mortgage Process!

Never close active credit card accounts. Closing out a credit card account you do not use will drop your credit scores. Also, never max out your current credit cards. This will also cause your credit scores to drop. Always maintain a 25% or less balance on your credit accounts.

Don’t Co-Sign for Others!

Never cosign for anyone during the mortgage application process. Cosigning will hurt your credit scores for two reasons. The first is the credit inquiry, the hard pull of your credit report, and the second, you are taking on more debt.

Do not enroll in any credit monitoring services as well. The less activity there is on your credit profile, the better. Any activities on your credit during the mortgage application process will alert the underwriter as a red flag. This will scrutinize your mortgage application process, and letters of explanation will be required, which might delay your home loan closing.

Be Timely On All Monthly Debts

Never be late on any monthly debt obligations. One late payment during the mortgage application process can potentially halt your home loan closing until there is a valid explanation.