Can I Do a Cash-Out Refinance In Chapter 13 Bankruptcy?

Homeowners with equity in their homes can do a cash-out refinance in Chapter 13 Bankruptcy repayment plan to buy out Chapter 13. Home prices have skyrocketed in the past four years. Home prices have gone up 43% nationwide. The coronavirus outbreak in 2020 did not make a dent in the housing market.

While the housing market was on fire, unemployment soared due to major changes due to politicians shutting down businesses. The coronavirus outbreak affected millions of Americans in the hospitality and service sectors. Millions of people did their share in helping hundreds of new recruits. Many homeowners are scared about lo highly what others are planning.

Learn more about Cash-Out Refinance in Chapter 13 Bankruptcy with us.

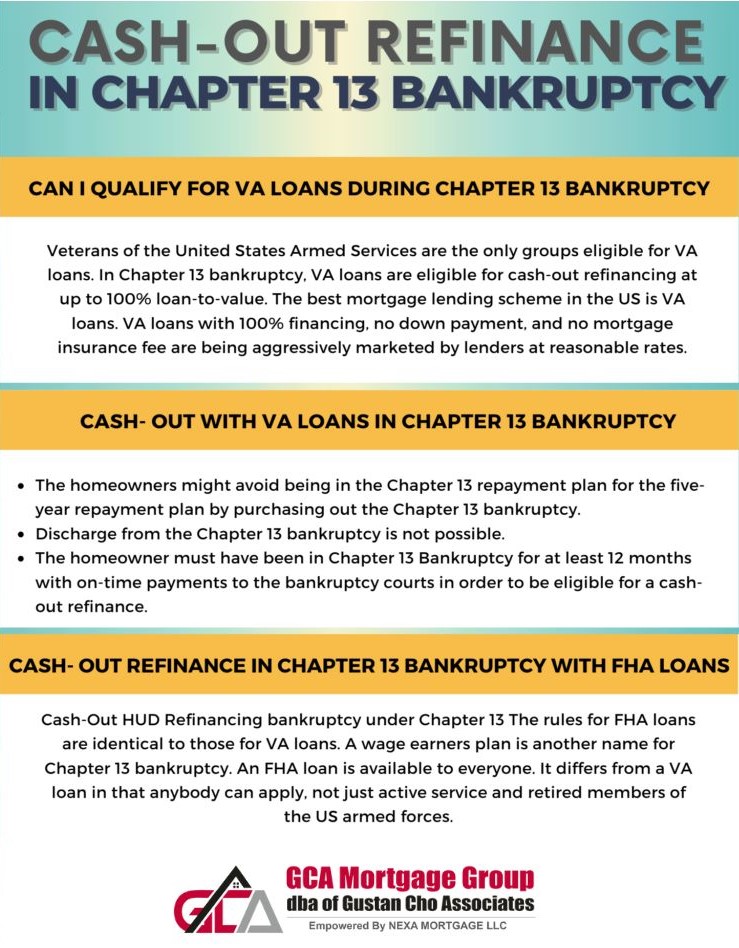

Can I Qualify For VA Loans During Chapter 13 Bankruptcy?

VA loans are only for active or retired members of the military and veterans of the United States Armed Services. Unmarried spouses of deceased eligible veterans are eligible for VA benefits on VA loans. You can get up to a 100% loan-to-value cash-out refinance in Chapter 13 Bankruptcy on VA loans. VA loans are the best mortgage loan program in the United States. Lenders are aggressively marketing VA loans with 100% financing with no money down and no mortgage insurance premium at competitive rates.

Maximum Loan Limit on VA Loans

VA loans do not have a maximum loan limit and have lenient mortgage lending requirements and guidelines. VA loans do not have a minimum credit score requirement, no maximum debt-to-income ratio for borrowers who have strong residual income, and no maximum loan limit on VA loans. The team at Gustan Cho Associates, Inc. are experts in helping mortgage borrowers with VA loans with bad credit and lower credit scores.

Cash-Out Refinance in Chapter 13 Bankruptcy With VA Loans

By buying out the Chapter 13 Bankruptcy, the homeowners do not have to be in the Chapter 13 repayment plan for the five-year repayment plan. The Chapter 13 Bankruptcy does not to be discharged. To be eligible for a cash-out refinance in Chapter 13 Bankruptcy, the homeowner needs to be in the Chapter 13 Bankruptcy for at least 12 months with timely payment to the bankruptcy courts. In the following paragraphs, we will discuss and cover qualifying for cash-out refinance in Chapter 13 Bankruptcy.

Cash-Out Refinance in Chapter 13 Bankruptcy With FHA Loans

HUD Cash Out Refinancing Chapter 13 Bankruptcy Guidelines on FHA loans are exactly the same as VA loans. Chapter 13 Bankruptcy is also called a wage earners plan. Anyone can qualify for an FHA loan. It is not like a VA loan where only active duty and retired members of the U.S. Armed Services can qualify.

Who Benefits From Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy benefit consumers with a regular consistent income and job. However, people are seeking relief from the U.S. Bankruptcy Courts for relief by restructuring their debts. A percentage of a person’s wages is taken out for the bankruptcy trustee to distribute to the petitioner’s creditors.

Prequalified in just 5 minutes. Click here!

Why Do People File Chapter 13 Bankruptcy?

It’s for people with regular income but a lot of debt. They have found themselves over their head in credit card debt, or other overwhelming debt. It’s a plan, usually 3-5 years, where an individual makes payment installations to repay debt.

Taking Advantage of Home Equity To Do a Chapter 13 Cash-Out Refinance Buy-Out

Homeowners can pay off Chapter 13 bankruptcy by doing a cash-out refinance. It is also an excellent option for clients to consolidate debt, build savings, or make home improvements. The remaining balance of your Chapter 13 can be paid off with the proceeds. There is no waiting period on discharge date for VA And FHA loans after Chapter 13 bankruptcy.

Can You Cash-Out Refinance During Chapter 13 Bankruptcy?

It is possible to do a repayment plan while still in Chapter 13. There are no laws on this. FHA and The VA have programs to assist with this and allow borrowers to qualify for a mortgage during the time they are in Chapter 13 repayment. You will need to be in the re payment plan for at least 12 months and meet the HUD agency guidelines.

Credit Score Required to meet HUD Guidelines on FHA Loans

Borrowers that have credit scores as low as 500 are still eligible to qualify for FHA loans. However, you need to remember that if you have less than 580 in credit score, you will need to put down a 10% payment instead of the 3.5 payment. There is debt to income restrictions on the manual underwriting that would have to happen in order for approval. The higher debt-to-income ratios will require you to have some compensating factors, which could possibly include cash reserves.

What Is Manual Underwriting in Mortgages?

FHA and VA loans are the only two mortgage options for homebuyers to purchase a home. Homeowners with equity can do a cash-out refinance in Chapter 13 Bankruptcy. Once someone files Chapter 13 Bankruptcy, they have one year to become eligible homebuyers. It is imperative that homeowners are being timely while in Chapter 13 Bankruptcy. Homeowners can do a rate and term refinance in Chapter 13 Bankruptcy.

Chapter 13 Bankruptcy Manual Underwriting Guidelines

Instead of being approved through the automated underwriting system, you would go through a process called manual underwriting. This is when a mortgage underwriter carefully goes through your credit file and determines your debt-to-income ratio, primarily by finding your compensating factors.

- With no compensating factors, underwriters will want to see the back-end debt to income ratio be 43% & front-end debt to income ratio is 31%

- The recommended back-end debt to income ratio is 47% & front-end debt to income ratio is capped at 37%, with one compensating factor.

- The recommended back-end debt to income ratio is capped at 50%& front-end debt to income ratio is capped at 40%, with two compensating factors.

Lenders consider compensating factors as lessening the risk of being unable to pay the loan back. Underwriters use these to approve the loan.

What Are Compensating Factors?

Debt-to-Income ratio caps can be as high as 50% if the mortgage underwriter finds multiple compensating factors.

- A larger down payment that is required by guidelines

- A non-borrowing spouse who works full time

- The borrower can show that they have saved money throughout the years

- At least one-month cash reserves, three months for a better compensating factor

- Payment Shock is less than 5%- Which is the difference from the current rent or mortgage to the new mortgage loan.

How to do cash-out refinance in Chapter 13 Bankruptcy?

Both VA and FHA refinance guidelines, while in Chapter 13, are the same. This is allowed homeowners to pull equity from their homes and pay off Chapter 13 debts which will end the bankruptcy sooner. Here is the mortgage process:

- After your loan has closed, one month’s worth of house payments should be saved (post-closing reserves).

- Must be 12 months’ worth of on-time payments to prove punctual payment history

- In the past two years, there can’t be more than one 30-day late payment in your credit report. This applies to any payment type. If it is on your credit report, it counts. This includes your mortgage payments.

- Borrowers can apply one year into the Bankruptcy repayment plan. However, some lenders have overlay requirements.

- Lenders would not honor HUD guidelines for qualification for an FHA loan during Chapter 13.

- The minimum credit score of 580 for the 3.5% down payment option.

In order to refinance for cash-out during Chapter 13, you will often need the court to approve the transaction.

Talk to an expert Loan Officer about cash-out refinance in chapter 13 bankruptcy.

Frequently Asked Questions (FAQs)

- Can I do a cash-out refinance while in Chapter 13 bankruptcy?

It’s possible but usually requires approval from the bankruptcy court and trustee. You’ll need to demonstrate a valid reason for the cash-out refinance and show that it’s in the best interest of your creditors. - What is the process for getting approval for a cash-out refinance in Chapter 13 bankruptcy?

You typically need to file a motion with the bankruptcy court and provide documentation supporting your request, such as the reason for the refinance, the proposed terms, and how it will benefit your financial situation. - What are the benefits of doing a cash-out refinance in Chapter 13 bankruptcy?

A cash-out refinance can help you access equity in your home to pay off debts or expenses. It also lowers your monthly mortgage payment if you can secure a lower interest rate or extend the loan term. - Are there any risks or drawbacks to doing a cash-out refinance in Chapter 13 bankruptcy?

One risk is that it may extend the length of your bankruptcy repayment plan if the court requires you to use the proceeds to repay creditors. Additionally, if you default on the new mortgage, it could jeopardize your home. - What factors will the bankruptcy court consider when reviewing my request for a cash-out refinance?

The court will consider your reasons for the refinance, the proposed terms of the new loan, your ability to afford the payments, and whether it’s in the best interest of your creditors. - Can I use the proceeds from a cash-out refinance for any purpose?

It depends on the approval from the bankruptcy court. Generally, the funds should be used for necessary expenses or to repay debts included in your bankruptcy plan. - Will a cash-out refinance affect my Chapter 13 repayment plan?

It could affect your repayment plan if the court requires you to use the proceeds to increase payments to your creditors or if it changes your financial circumstances significantly. - Can I work with any lender for a cash-out refinance during Chapter 13 bankruptcy?

Not all lenders may be willing to work with individuals in Chapter 13 bankruptcy, so you may need to find a lender specializing in these situations.

This can all sound very overwhelming to people who want to do cash-out refinance in Chapter 13 bankruptcy. However, it’s an excellent option for people who wish to pay off their debt and have home equity. It is crucial to find a lender who specializes in bankruptcy and will work through this process with you.

Gustan Cho Associates are experts when it comes to cash-out refinance in chapter 13 bankruptcy. Call us at (800) 900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays!