How To Get FHA Condominium Loans Approved

In this blog, we will cover and discuss how to qualify and how get FHA condominium loans approved. Condominiums are becoming increasingly popular. Many folks of all age groups are interested in condo living. Condominiums have condo homeowners associations. The condo HOA runs the exterior and common areas of the condominium community.

What Does The Condo Homeowners Association Do?

Everything to do with the exterior and common areas of the condominium community, the condo homeowners association takes care of. The residents of the condo complex are charged a monthly HOA fee. It is the funds of these fees that third-party vendors as well as all employees get paid. We will be covering how to get FHA condominium loans approved for buying a condominium.

HUD Guidelines on FHA Condominium Loans

Condominium ownership has taken a considerable increase in the past few years. A condo is a building with several residential units, which are all individually owned. The FHA extends mortgage insurance to those who wish to purchase condos instead of single-family properties. The FHA is the Federal Housing Authority.

FHA Condominium Loans For First-Time Homebuyers

Most individuals who turn towards the FHA Loan type are first-time home buyers. This could mean that they have fewer savings or even lower credit scores. The FHA does not issue loans but insures them. This makes lenders more willing to work with people who wouldn’t otherwise meet requirements. The FHA assists low to moderate-income families purchase homes because it keeps the initial costs down and by helping those who might not meet conventional loan guidelines. Get pre-approved in just 5 minutes. Click here!

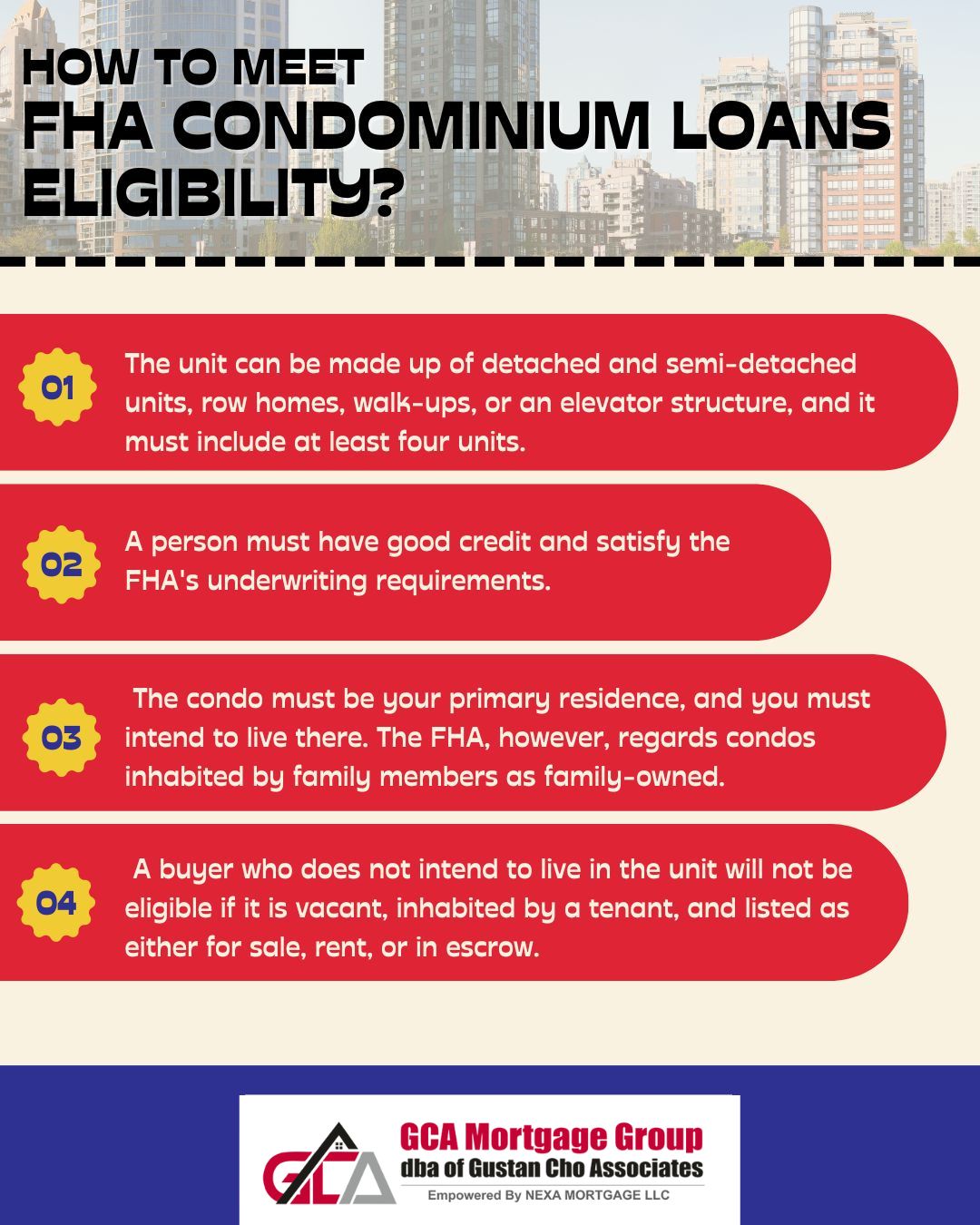

How to Meet FHA Condominium Loans Eligibility?

The unit must be made up of at least four units and can be made of detached and semi-detached units, including row houses, walk-ups, or an elevator structure. An individual should be creditworthy and meet the underwriting criteria of the FHA. You must intend to live in the condo, as your primary residence. However, the FHA considers condos occupied by family members as family-owned. If it is occupied by a tenant, vacant, and listed as either for sale, rent, or in escrow, a buyer who does not plan on living in the unit will not qualify.

FHA Condominium Loans Guidelines for Approval

There are eligibility requirements for purchasing a condo through the FHA. The condo must be your primary residence. 46.9% front-end and 56.9% back-endo debt-income ratio. A credit score of 500 or higher. Have at least a 3.5% down payment

Are there restrictions to qualify for an FHA Condominium Loans?

There would be some restrictions if the property were an apartment building before being converted. These restrictions include if the building was converted less than one year before the application. The potential buyer or co-buyer was a tenant of the rental housing, or if the conversion is sponsored by a tenant’s organization representing most of the household in the project.

Pros and cons of Getting FHA Condominium Loans

Pros:

- Reduced Down Payment Requirement: FHA loans usually demand a reduced down payment in comparison to conventional loans, enhancing accessibility to homeownership, particularly for first-time buyers or individuals with restricted funds for a down payment.

- More Lenient Credit Requirements: FHA loans frequently feature more adaptable credit score criteria than conventional loans, enabling borrowers with imperfect credit histories to qualify for financing.

- Fixed Interest Rates: FHA loans offer fixed-rate options, affording borrowers stability and predictability in their monthly mortgage payments throughout the loan’s duration.

- Assumable Loans: FHA loans offer assumability, allowing the buyer of your condominium to assume your existing FHA loan when you decide to sell, potentially simplifying the process of selling the property.

- Government Backing: FHA loans are backed by the Federal Housing Administration, mitigating lenders’ risk. This support enables lenders to provide borrowers with more favorable terms, including reduced interest rates and down payment requirements.

Cons:

- Mortgage Insurance Premiums (MIP): FHA loans require borrowers to pay mortgage insurance premiums (MIP) upfront and annually, which can increase the overall cost of the loan compared to conventional loans.

- Property Eligibility Requirements: FHA loans have strict eligibility requirements for the condominium project itself, including occupancy rates, financial stability of the homeowners association (HOA), and adherence to FHA property standards. Not all condominium projects may meet these requirements.

- Loan Limits: FHA loans have maximum loan limits set by the Federal Housing Administration, which may restrict the financing available for higher-priced condominium units in certain areas.

- Risk-Based Pricing: Although FHA loans provide greater flexibility in credit requirements, borrowers with lower credit scores might encounter higher interest rates or supplementary fees, termed risk-based pricing, in contrast to borrowers with higher credit scores.

- Resale Limitations: FHA condominium loans may restrict the property’s resale within a certain timeframe, limiting flexibility for homeowners who plan to sell their condominium shortly.

Before deciding to pursue an FHA condominium loan, it’s essential to carefully weigh these pros and cons and consider your financial situation and homeownership goals. Seeking advice from an experienced mortgage lender can offer valuable insights and personalized guidance to meet your particular requirements.

What if the condo is not built yet?

This can be approved, but the FHA will require more documentation. Below is some additional documentation that an FHA lender might ask for if the condo is not yet built. These will come from the developer of the condo.

- A Site plan

- Location map

- A written explanation of the condominium structure type, number of units, and details about the common area

- An application, HUF Form 92250 for environment review

- A letter from the state Historic Preservation Administration stating that the project is accepted

- A proposed operating budget for the site

- A management plan for the condo once it’s completed.

Condos existing less than a year

FHA will only allow for a 90% loan with 10% down for condos that have existed for less than a year. The FHA will want to see documentation such as the location map, developers’ plan for development, legal documents for the condo, a budget for the condo association, and a current financial statement for the condo, which must include the reserve cash fund.

For an already-established condo

This will be much easier to get approved for an FHA Condo Loan once it’s established! However, getting approved for a condo can still be more challenging than a single-family home.

This is for all condos that have been established for a year or more and have an active Homeowners Association. The lender will want to see minutes from the last two condo association meeting minutes, a report from the management company, the annual budget and reserve funds, the plot map, and a document that details the plot. Any condos that are in the red for their operating budgets will not be approved.

The FHA feels that a condo purchase involves more risk because if one unit goes into foreclosure, the potential for all the units’ value to decrease is present. Because this is a concern, the FHA enacts more robust guidelines to protect against this occurring.

How to Apply For FHA Condominium Loans

In order to get an FHA loan for a condo purchase, you will need to find a lender who is FHA loan approved. Look for a lender who accepts lower credit scores if this concerns you. Once you have found a lender, you will complete an application online or through your loan officer. It is important to compare lenders to ensure you receive the best deal- lower interest rates and fees, if possible.

Lenders will naturally check your credit score, but if they check within a 30-45 day window, it will not affect your score immediately. You will then provide supporting documents, and you should receive loan estimates within three days. Condos have become the new type of preferred residential home for many people. Click here to apply for FHA condominium loans

Frequently Asked Questions (FAQs)

- What are the requirements for FHA condominium loans approval?

To get an FHA condominium loan approved, the project must meet certain eligibility criteria set by the FHA. This includes factors such as the percentage of owner-occupied units, the homeowners association’s (HOA) financial stability, and adherence to FHA occupancy guidelines. - How can I find out if a condominium project is FHA-approved?

You can check the FHA-approved condominium list on the Department of Housing and Urban Development (HUD) website. Additionally, your lender can help you determine if a specific condominium project meets FHA requirements. - Can I get an FHA loan for a condominium in a non-FHA-approved project?

In some cases, obtaining an FHA loan for a condominium in a project that is not currently FHA-approved may be possible. However, the project must meet FHA eligibility requirements, and the lender may need to seek FHA approval on a case-by-case basis. - What are some common reasons for FHA condominium loans denials?

Common reasons for FHA condominium loan denials include insufficient owner occupancy within the condominium project, financial instability of the HOA, pending litigation, or failure to meet FHA property standards. - Can I appeal a denial of an FHA condominium loan?

Yes, you can appeal a denial of FHA condominium loans. This may involve providing additional documentation or information to address the reasons for the denial. Working with your lender and HOA can help in the appeal process. - What are the benefits of FHA condominium loans?

FHA condominium loans typically necessitate smaller down payments and offer more lenient credit requirements compared to conventional loans. They also offer competitive interest rates and are backed by the federal government, providing added security for lenders. - How long does it take to get FHA condominium loans approved?

The timeframe for approval of FHA condominium loans may fluctuate based on variables like the intricacy of the condominium project and the promptness of responses from both the homeowners association (HOA) and the lender. Generally, getting approval can take several weeks to a few months.

Gustan Cho Associates can help you with your FHA condominium loans journey. Call us now at (800) 900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays!