Non-Occupied Co-Borrowers Mortgage Guidelines On FHA Loans

This BLOG On Non-Occupied Co-Borrowers Mortgage Guidelines On FHA Loans

There is more to qualify for FHA Loans with just have a good-paying job and great credit scores.

- Whether it is FHA, VA, USDA, Fannie Mae, Freddie Mac, Jumbo, or any other loan program, lenders will want to know if borrowers are able to re-pay their mortgage loans

- Debt To Income Ratio is calculated by adding the sum of all of the minimum monthly debt payments of the borrower and dividing it by the borrower’s monthly income

- Every loan program has its own debt to income ratio requirements

- In this article, we will talk about FHA Loans and its guidelines on non-occupant co-borrowers

In this blog, we will cover and discuss the Non-Occupied Co-Borrowers Mortgage Guidelines On FHA Loans.

Reason Why Non-Occupied Co-Borrowers Are Required

Many home buyers can afford homes with the income they make. However, due to extensive write-offs on tax returns or getting paid cash, a percentage of that income can not be used as qualified income. In instances like these, HUD allows non-occupant co-borrowers:

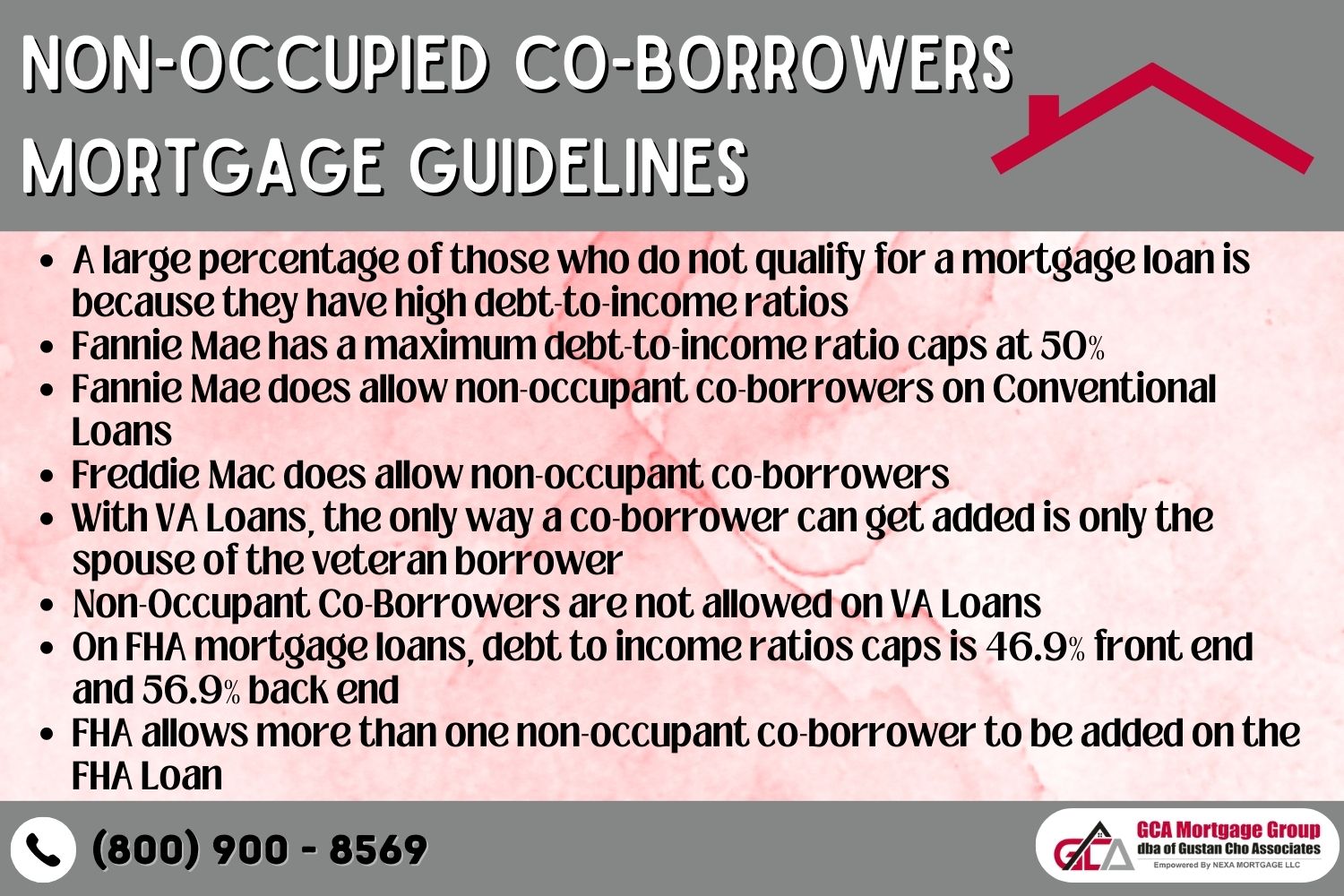

- A large percentage of those who do not qualify for a mortgage loan is because they have high debt to income ratios

- Fannie Mae has a maximum debt to income ratio caps at 50%

- Fannie Mae does allow non-occupant co-borrowers on Conventional Loans

- Freddie Mac does allow non-occupant co-borrowers

- With VA Loans, the only way a co-borrower can get added is only the spouse of the veteran borrower

- Non-Occupant Co-Borrowers are not allowed on VA Loans

- On FHA mortgage loans, debt to income ratios caps is 46.9% front end and 56.9% back end

- FHA allows more than one non-occupant co-borrower to be added on the FHA Loan

Manual Underwriting requires compensating factors.

What Are Compensating Factors?

Compensating factors are beneficial factors that make a mortgage loan borrower credit profile look stronger thus avoiding risk factors from the mortgage lender.

Examples of compensating factors are the following:

- 3 months reserves

- Payment Shock of 5% or $100 whichever is less

A borrower having a second job and has been on that second job for at least 12 months but is not used as qualifying income.

What Are Debt To Income Ratios

Debt to income ratios is the amount of total monthly payments you have divided by your total gross monthly income.

- For example, if a mortgage loan applicant has a car payment of $200 per month, minimum credit card payments of $200 per month, and a student loan of $100 per month, total monthly payments are $500 per month.

- Taking the $500 per month total monthly payments and dividing it by total gross monthly income yields the debt to income ratio.

- Say monthly gross income is $1,000, then take monthly debt obligations of $500 and divide it by gross income of $1,000 which yields 50%

- Debt to income ratio is 50%

Utility payments, cable tv payments, internet payments, insurance payments, and other payments like cell phone payments are not factored in when calculating debt to income calculations.

Non-Occupied Co-Borrowers

FHA mortgage loans allow non-occupied co-borrowers.

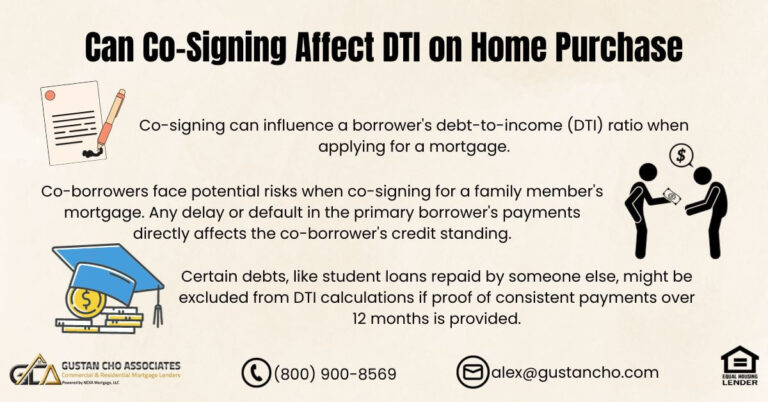

- Non-Occupied Co-Borrowers are often needed if the main borrower has a high debt to income ratios

- The most common monthly debts that spike debt to income ratios are monthly car payments and child support/alimony payments and student loan payments

- A car payment is usually $200 a month or more per month which is equivalent to a $40,000 worth of buying power on a home purchase

- The maximum debt to income ratio that a borrower can qualify for an FHA loan is 56.9%

FHA and Freddie Mac is the only mortgage loan program that allows a non-occupied co-borrowers.

Credit Scores Of Co-Borrowers

When it comes whose credit scores the mortgage lender uses, the mortgage lender uses the middle credit scores of the lower credit scores of borrowers.

- Mortgage borrowers have non-occupied co-borrowers and their middle credit scores are 640 FICO and the borrower’s credit scores are 720 FICO, the non-occupied co-borrowers credit scores of 640 FICO will be used for mortgage underwriting purposes

- HUD requires that Non-Occupant Co-Borrowers be related to the borrower by law, marriage, or blood for 3.5% down payment home purchase loans

- If the non-occupant co-borrower is not related by law, marriage, blood, HUD requires the main borrower to put 25% down payment

- Fannie Mae and Freddie Mac does not require non-occupant co-borrowers to be related by blood, marriage, blood

Borrowers with higher debt to income ratios who needs to get qualified with a lender with no lender overlays, please contact us at 1-800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.