Benefits of Owning Versus Renting a Home

In this blog, we will cover the benefits and reasons for owning versus renting a home. One of the misconceptions renters have is you need a 20% down payment, closing costs, and good credit to qualify for a mortgage. This is not the case. VA and USDA offer no down payment on a home purchase with 100% financing. FHA loans require a 3.5% down payment with a 580 credit score with less than perfect credit. You can qualify for FHA and VA loans with credit scores down to 500 FICO.

The Benefits of Tax Benefits For Owning Versus Renting a Home

The Tax Code lets you deduct interest paid on the mortgage, property taxes, and some costs involved when purchasing a home.

When you rent, you miss out on those deductions.

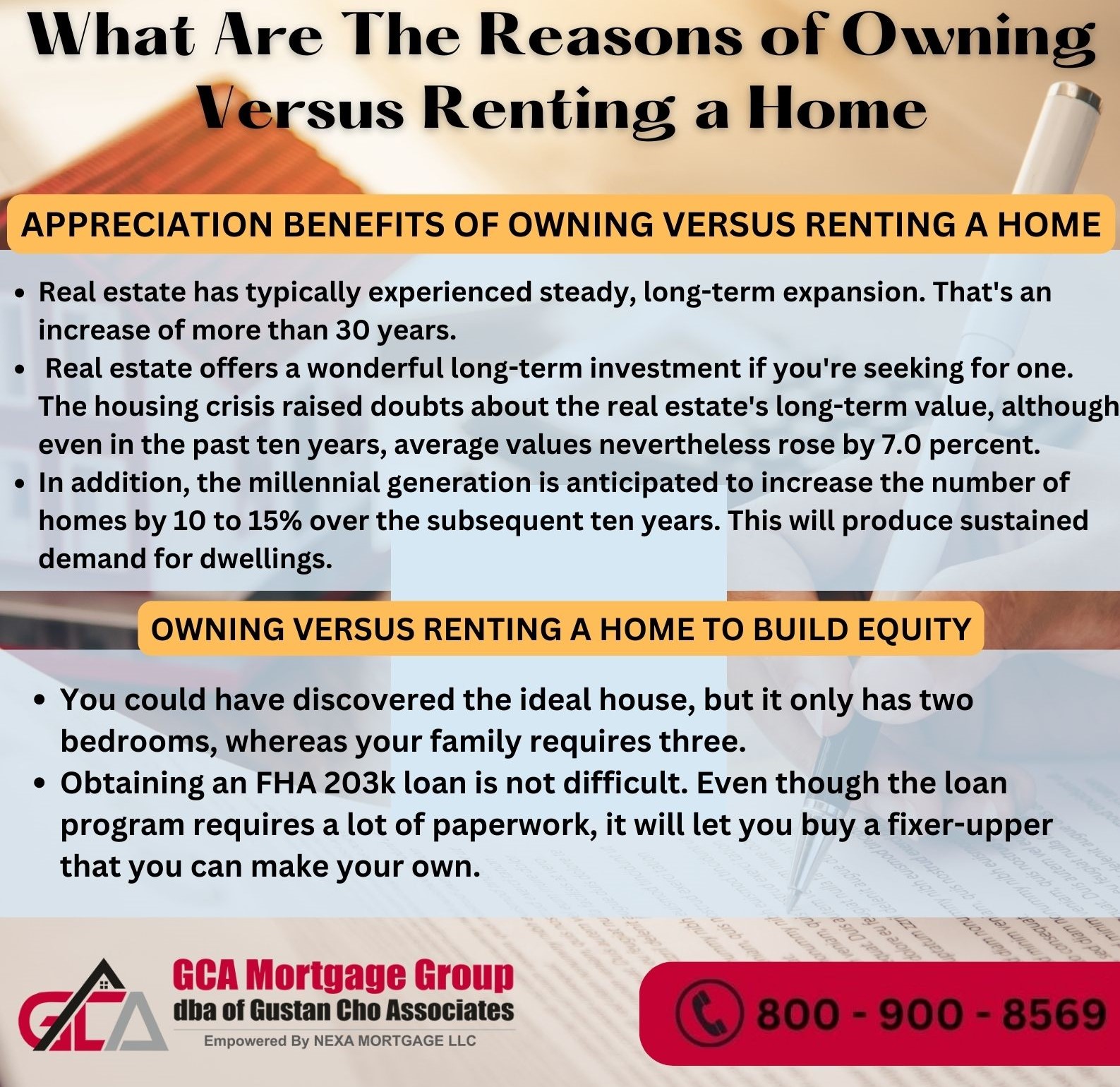

Appreciation Benefits of Owning Versus Renting a Home

Historically, real estate has gained long-term, stable growth. According to the National Association of Realtors, home sale prices have increased 5.2 percent per year from 1972 through 2014. That’s over 30 years of growth.

If you’re looking for a good long-term investment, real estate provides that. The housing crisis created concern regarding the long-term value of the real estate, but even in the last decade, overall values still increased by 7.0 percent.

Additionally, with the millennials, the number of households is expected to rise 10 to 15 percent over the next ten years. This will create continued demand for housing.

Owning Versus Renting a Home To Build Equity

Mortgage payments let you build equity. The payments you make go towards building equity. When you pay rent, you help someone else build equity. Think of it as a built-in savings plan.

When you sell, you can take up to $250,000 for an individual and $500,000 for a married couple as a gain without paying income tax on it.

Does Monthly Fixed-Rate Mortgage Payment Increase?

The principal and interest remain the same throughout a 15 and 30-year fixed-rate mortgage. However, property taxes and homeowners insurance can increase or decrease depending on the property tax and homeowners insurance premium.

Rental payments normally always increase every year when the tenant renews the lease. On average, rent payments increase from 5% to 7% every year when the rental agreement is renewed.

How Does Monthly Housing Payments Change Owning Versus Renting a Home?

Unlike rent, with a fixed-rate mortgage, payments don’t rise over the years. So your payments may decline over time. Investors that own rental properties increase monthly rents by an average of 5 percent per year.

Keep in mind property taxes and insurance costs will likely increase but the monthly mortgage payment will stay the same, unlike monthly rent from year to year.

Freedom Is a Reason For Owning Versus Renting a Home

The home is yours to decorate however you like and add upgrades, additions, or any other changes. You can also make alterations as your lifestyle, preferences, or needs, such as a growing family, change without requesting permission (unless it’s work that requires a permit).

Remaining in the same area for several years also provides social benefits such as building long-lasting relationships with neighbors and others in the community. If you have kids, they also benefit from that educational and social continuity.

Plus, you don’t have to worry that your landlord may decide to sell and not renew your lease. Now you must house hunt, pay moving costs, and deal with the hassle.

What Are The Best Mortgage Options In The Marketplace?

The team at Gustan Cho Associates are experts in helping first-time homebuyers, borrowers with prior bad credit, homebuyers with credit scores down to 500 FICO, self-employed borrowers, 1099 income wage earners, W2 income only mortgage borrowers, non-QM and alternative mortgage borrowers, and no-doc mortgage borrowers.

Gustan Cho Associates, empowered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states with a lending network of 210 wholesale mortgage lenders including dozens of no overlay government and conventional lenders and dozens of non-QM and alternative lending partners.

The team at Gustan Cho Associates are experts in being able to do mortgage loans other loan officers cannot do. Gustan Cho Associates are mortgage brokers licensed in 48 states, including Washington DC, Puerto Rico, and the U.S. Virgin Islands.

Gustan Cho Associates Has The States, Products, and The Lowest Rates

We are experts in working with realtors nationwide, especially in our home state of Illinois and hometown of Chicago and surrounding suburbs. We work closely with veteran real estate agents who represent home buyers and home sellers in Chicago and its surrounding suburbs. Our referral network of real estate agents represents home buyers and sellers in Cook County, Lake County, Kane County, DuPage County, McHenry County, and Lake County.

Why Choose Us at Gustan Cho Associatesc?

Our team of associate contributing editors at Gustan Cho Associates are experts in real estate home values in the Chicagoland area. Our dually licensed realtor and mortgage loan officer associate contributing editors diligently keep an eye on what sells and check the MLS daily hot sheets.

Proudly to say Gustan Cho Associates has a team of the best of the best dually licensed realtor and mortgage loan officer agents in the nation who know what comes out on the market every day.

If you have any questions about owning versus renting a home and any of our mortgage loan programs, please get in touch with us at Gustan Cho Associates at 262-716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates and its affiliates are available seven days a week, evenings, weekends, and holidays.