What Are Compensating Factors For Manual Underwriting

Many borrowers often ask the question what are compensating factors? Lenders are not required to originate and fund mortgage loans. Just because there are home loans that are insured by the government such as FHA, VA, and USDA Loans, It is not a requirement for lenders to follow the minimum government lending guidelines.

Lenders can have their own overlays. Lenders can set their own lending standards that are above and beyond those of FHA, VA, and USDA. These additional mortgage lending guidelines are called lender overlays. In this article, we will cover and discuss and answer a frequently asked question on what are compensating factors on a manual underwrite.

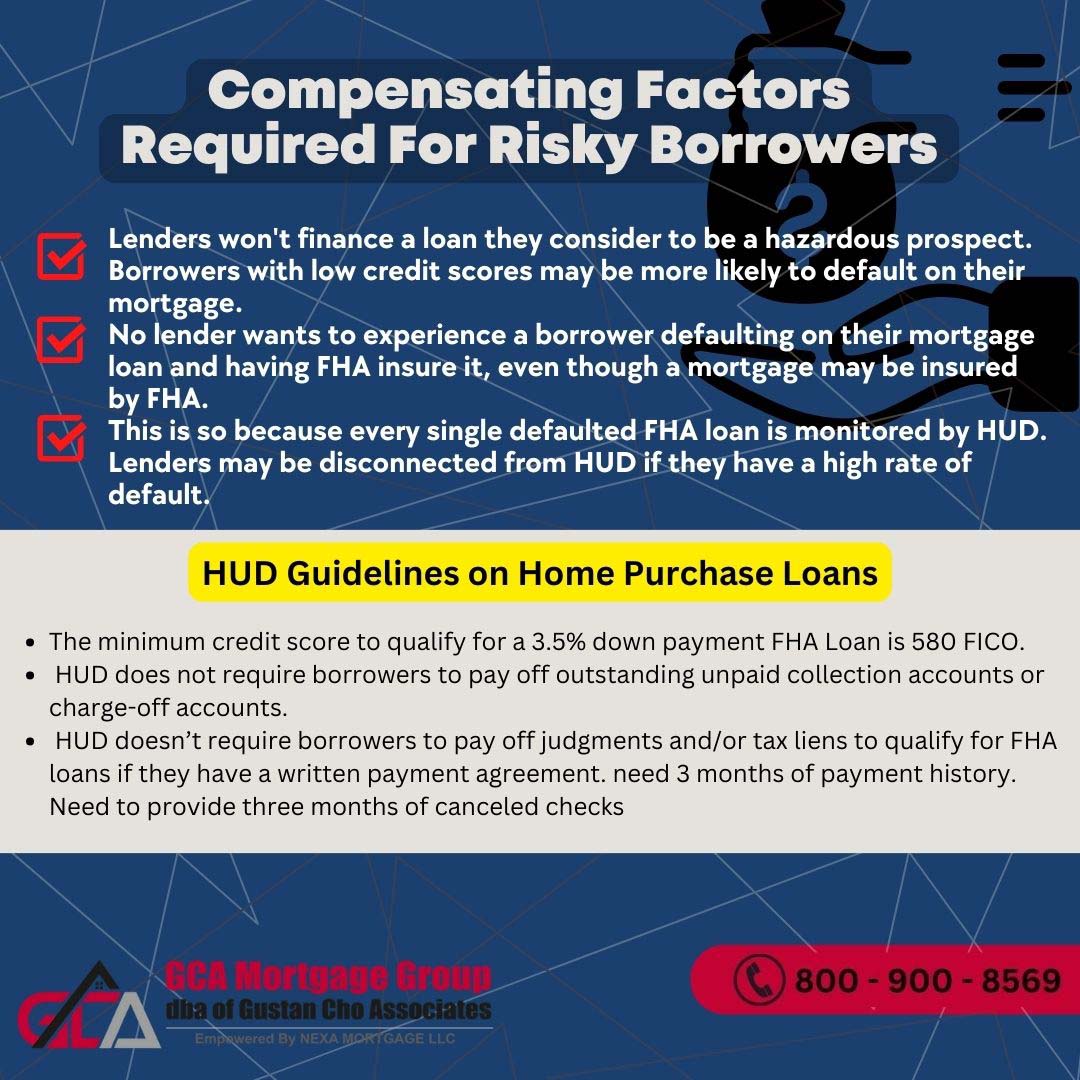

Compensating Factors Required For Risky Borrowers

Lenders will not fund a loan that they feel is a risky candidate. Low credit score borrowers may have a high probability of defaulting on their home loan.

Even though a mortgage may be insured by FHA, no lender wants to go through a borrower defaulting on their mortgage loan and having FHA insure it. This is because HUD monitors every single defaulted FHA loan. If lenders have a high default rate, they can be cut off HUD

How Compensating Factors Help Higher-Risk Loans

What Are Compensating Factors? Compensating Factors are positive factors that a borrower has that will strengthen the borrower’s credit profile. Mortgage Underwriters look for strong compensating factors on borrowers who have a higher layer of risk such as the following:

- Low credit scores

- No established credit

- Borrowers who live with family and have no verification of rent

- Those who have large amounts of outstanding collection accounts

- Buyers with higher debt-to-income ratios

- Folks with gaps in employment and short-term on-job or industry

- Homebuyers who do not have their own funds for the down payment and closing costs and are depending on gift funds

- Consumers with other credit or financial issues that pose a higher risk level

What Are Compensating Factors on Home Loans

FHA loans are by far the most popular loan program in the United States today. Borrowers with the following can qualify for FHA loans:

- bruised credit

- prior bankruptcies

- foreclosures

- deed in lieu

- short sale

- outstanding collection accounts

- charge off accounts

- higher debt-to-income ratios

- recent late payments

- no or little credit tradelines can often qualify for an FHA loan

But depending on their credit profile, compensating factors may be required for them to get mortgage approval. FHA’s lenient mortgage lending guidelines make it possible for many hard-working Americans to qualify for an FHA Loan. But yet, lenders are very careful about who they lend to. This is because the last thing they want is for the borrower to default on their FHA loan and go into foreclosure/

HUD Guidelines on Home Purchase Loans

Below are the FHA Guidelines to qualify for an FHA loan. The minimum credit score to qualify for a 3.5% down payment FHA Loan is 580 FICO. HUD does not require borrowers to pay off outstanding unpaid collection accounts or charge-off accounts. HUD doesn’t require borrowers to pay off judgments and/or tax liens to qualify for FHA loans if they have a written payment agreement. need 3 months of payment history. Need to provide three months of canceled checks

HUD Gift Funds and Non-Occupant Borrower Guidelines

HUD permits to get 100% gifted funds by a family member to be used for the down payment and closing costs. HUD allows borrowers to have multiple non-occupant co-borrowers. Non-occupant co-borrowers needs to be related to the borrower by blood, law, or marriage.

HUD allows debt-to-income ratios to be capped at 56.9% DTI for borrowers who have greater than 620 Credit Scores. Borrowers with credit scores can have a maximum debt-to-income ratio not greater than 43% DTI.

Chapter 13 Bankruptcy Mortgage Guidelines on FHA and VA Loans

Borrowers who are in a Chapter 13 Bankruptcy Repayment Plan can qualify for VA and FHA loans one year into the Chapter 13 Bankruptcy Repayment Plan. Need approval of the Chapter 13 Bankruptcy Trustee. Proof of 12 months of timely payments. This is manual underwriting.

All manual underwrites require verification of rent. HUD has no waiting period after a Chapter 13 Bankruptcy Discharged Date. If you have several of the above conditions, compensating factors will help. Compensating factors are factors that help borrowers offset the negatives on their credit and financial profiles.

What Do Lenders Consider Compensating Factors

What Are Compensating Factors? There are five solid compensating factors lenders like to see with high-risk mortgage loan applicants. Compensating factors will offset risk levels loan applicants has.

Will help mortgage underwriters approve the file when it can be potential denial.

Compensating Factors Mortgage Underwriters Will Take Into Consideration

Compensating factors are positive factors lenders will take into account for high debt-to-income ratio borrowers on manual underwriting. It is the number of compensating factors that will allow higher debt-to-income ratio borrowers on manual underwrite. In the paragraphs below, we will cover compensating factors that lenders will take into consideration:

Verified and Sourced Funds

You can use gift funds for the down payment and closing costs. Reserve Funds cannot be gifted funds. Reserves are the borrower’s own funds that are above and beyond the funds needed to close.

Reserves funds that are verified funds that are equal to or greater than three months of the proposed P.I.T.I. (Principal, Interest, Taxes, Interest) of the subject property. If a borrower is getting financing on a two to four-unit property, the borrower is required to reserve. All multi-family homes require reserve funds.

Mortgage Guidelines on Reserves

Three months of reserves are considered a strong compensating factor for the borrower. Verified and documented reserve funds that are equal to 6 months of P.I.T.I. on three to a four-unit subject, purchase properties are considered strong compensating factors.

Payment Shock and Verification of Rent

Mortgage underwriters give a lot of positive weight to low payment shock. Payment shock is when you go from paying rent to paying a new mortgage payment. Lenders are often concerned with Payment Shock.

Payment Shock is when renters go from how much they are currently paying for rent to what they will be paying on the mortgage payment. Or the least increase they will have from paying rent to paying their new mortgage payment, the better.

What Are Compensating Factors For Low Payment Shock?

What are compensating factors for payment shock? A great compensating factor when it comes to payment shock is if your new P.I.T.I. does not exceed 5% or $100.00, whichever amount is the lesser.

This is proven and documented by providing 12 months of canceled checks that are paid to the landlord. Timely 12 monthly payments are only considered compensating factors and no late payments. On a purchase transaction, many lenders will allow one 30-day late rental payment in the past 12 months.

Borrowers With No Discretionary Monthly Debt Payments

Borrowers Do Not Have Discretionary Debt. Another compensating factor is when there are no other debts other than the proposed housing debt. For example, credit card debts are paid off in full monthly, and no installment loans or other loans. Credit tradelines are compensating factors as well but need to be paid off in full in the past six months.

Significant Additional Other Income

Additional other income such as overtime income, bonus income, part-time income, or seasonal employment income is not used for income qualification purposes on the mortgage loan application. Have been seasoned for at least one year. Is likely to continue and is considered as compensating factor.

Residual Income Is Considered Compensating Factor

Borrowers need to have a residual income. This includes all members of the household of the occupying Borrower without regard to the nature of their relationship. An individual may be omitted from the “family size” if they are fully supported by a source of verified income which is not included in the effective income (must be documented).

If you have further questions on compensating factors, please contact Gustan Cho Associates at 262-716-8151 or text for a faster response. Or email us at gcho@gustancho.com.