Should I Use Preferred Lenders Steered By Builders

In this blog, we will cover and discuss preferred lenders steered by builders on a home purchase. Many home builders have preferred lenders steered by builders. Preferred lenders steered by builders are mortgage companies who either have a business referral network with the home builder.

In other cases, the builder may have an interest in the mortgage company such as own the mortgage company. In the following paragraphs, we will be covering and discussing preferred lenders steered by buliders and violating steering laws.

Why Does Home Builder Want Me To Use Their Lender?

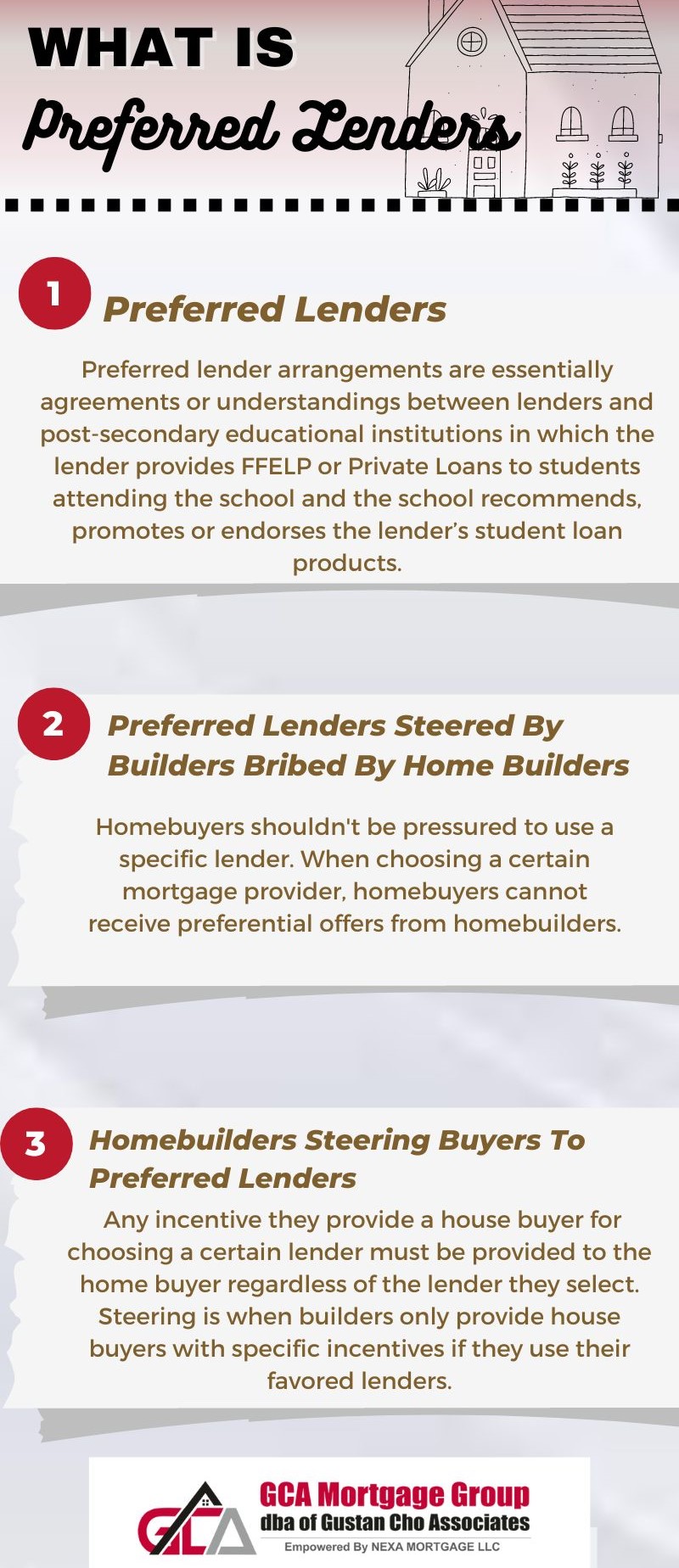

What Is Preferred Lending?

Alex Carlucci is a preferred lender for several home builders. Alex Carlucci is one of the moral lenders because he does not give kickbacks which are illegal to take the kickback or give a realtor a kickback. Here is how Alex Carlucci answers the question of what is preferred lending.

Nothing is illegal or against the law to recommend a lender to a home buyer. But many home builders are crossing the line by pushing and steering their prospective home buyers to go with preferred lenders steered by builders.

Why Lenders Not Like New Builds?

Alex Carlucci a senior licensed mortgage loan originator at Gustan Cho Associates responds to why mortgage lenders do not like new builds. Here is what Carlucci says after he was asked why Lenders do Not Like New Builds:

Most lenders believe new home buyers are paying premium prices for new homes and the home will lose value the moment you move in. It can be very difficult to re-sell a new home (at a fair market price) whilst the house builder’s sales staff is still in development.

Preferred Lenders Steered By Builders Bribed By Home Builders

Homebuyers should not be coerced to go with a particular lender. Homebuilders cannot offer special deals to home buyers if and only if they go with a particular mortgage lender. In this article, we will discuss and cover Preferred Lenders Steered By Builders On Home Purchases.

Homebuilders Steering Buyers To Preferred Lenders

Homebuilders can, however, recommend a particular mortgage company. Whatever incentive they offer a home buyer by going with a particular lender, they need to offer it to the home buyer with whichever lender they choose. If they only offer the home buyer certain incentives if they only go with preferred lenders steered by builders, it is known as steering.

Builders who demand buyers to only go with the builder’s preferred lender and not the lender of the home buyer’s choice, they are in violation of steering. They can get fined, shut down, and subect to steering violation by the Consumer Financial Protection Agency,

Can a Builder Insist You Use The Builder’s Preferred Mortgage Broker?

A builder can’t insist that you use their preferred mortgage broker. Builders steering homebuyers to their preferred lender has been a practice for decades. Homebuyers not using the builder’s preferred mortgage broker will not get the same incentives as buyers using the builder’s preferred mortgage broker.

Home buidlers steering homebuyers to their preferred lender can be in violaton of the CFPB Anti-Steering laws . Builders who steer borrowers to their preferred lenders by giving incentives and not the lender of the borrower’s choice can get into big trouble.

What Is Steering In Mortgage Lending

The CFPB does not mess around. They are one of the most powerful regulatory agencies when it comes to consumer protection and when it comes to mortgage regulations. The CFPB does not just warn home builders of anti-steering law violations but will assess hundreds of thousands if not millions of dollars in fines.

CFPB Anti-Steering Laws

Anti-Steering mortgage rules and regulations were created to protect borrowers. Real Estate companies, home builders, and mortgage companies cannot steer borrowers to certain mortgage programs or certain mortgage companies for their benefits. Companies need to disclose to home buyers and borrowers that they can shop for the best rate and terms.

Preferred Lenders Steered By Builder Through Steering

Lenders need to disclose their mortgage rates and terms as well as other loan options they have. A loan originator cannot offer one applicant a certain mortgage rate and term for a particular loan program and another borrower a more favorable mortgage rate and term for the exact loan program. This is a serious mortgage loan regulation violation. The Consumer Protection Financial Bureau takes this extremely seriously.

How Home Builders Violated Preferred Lenders Steered By Builder

Even though it is against the law, many home builders today are violating anti-steering laws and are getting away with it. Home builders that are offering a builder’s concession towards upgrades and a builder’s concession towards closing costs. There is a catch.

Does The CFPB Regulate Mortgage Companies?

The Consumer Financial Protection Bureau, the CFPB, is the federal agency in charge of consumer protection in the United States. The enforcement duties of the CFPB includes protecting consumers from predatory lending from mortgage companies. The CFPB regulates not just mortgage companies but other consumer lending entities such as banks, thrifts, credit unions, auto loans, consumer loans, and PayDay loans.

Builders are only offering builder’s concessions only as long as they go with the home builder’s preferred lender. The deal is not valid if the homebuyer goes with a different lender. Builders coercing homebuyers into their preferred lenders are in total violation of anti-steering laws and mortgage regulations.

How Do I Know Which Lender To Use?

Not all mortgage lenders have the same lending requirements for the same loan program. For example, a lender can require a higher credit score requirement than the minimum HUD agency mortgage guidelines. For example, you need a 580 credit score to qualify for a 3.5% down payment FHA loan per HUD guidelines. However, a lender may require a 640 credit score to qualify for an FHA loan. The higher credit score requirement by the lender is an overlay on credit score. Therefore, just because you do not qualify with one lender does not mean you can’t qualify with a different mortgage lender.

Case Scenario of Preferred Lenders Steered By Builders

My borrower went shopping for a home and decided to purchase a home with a national homebuilder and decided to go with the home builder’s preferred lender. This is because they offered him a $5,000 builder’s credit if they went with the home builder. But the $5,000 builder’s credit was not available if he went with me or any other lender. Unfortunately, the preferred lender could not do the loan and the borrower got denied the mortgage loan.

Preferred Lender Steered By Builder Cannot Take Kickbacks

Since the home broke ground and the borrower got a last-minute denial, the home builder told the home buyer if he got another lender that can do his mortgage loan, that they will make an exception and honor the $5,000 builder credit. The home buyer came back to me and I ended up closing the mortgage loan. This is a typical case study where many home builders are violating anti-steering laws.

Kickbacks To Builders By Mortgage Lenders For Steering Borrowers Is Mortgage Fraud

The CFPB is the federal agency in charge of administering consumer protection from potential predatory mortgage lenders. Getting kickbacks from lenders is totally illegal and considered mortgage fraud. Mortgage Fraud is a felony punishable by up to 30 years per count.

PMortgage companies giving kickbacks to home builders can not only lose their mortgage licenses but can get fined millions and get charged criminally. Unfortunately, the CFPB does not have the manpower to be cracking down on these builders.